Good morning! It’s Monday, April 22, 2024, and this is The Morning Shift, your daily roundup of the top automotive headlines from around the world, in one place. Here are the important stories you need to know.

1st Gear: Chaos At Tesla

2024 has not been kind to Tesla. Its sales are slumping, CEO Elon Musk is making bizarre product decisions, the Cybertruck is falling apart, prices are being cut, 10 percent of the staff has been laid off, the board wants to give Musk $56 billion and all of this has led to the stock slipping over 40 percent since the beginning of the year.

That isn’t the end of the bad news, though. On Tuesday, the Austin, Texas-based automaker is expected to report a 40 percent dive in operating profit and its first revenue decline in four years (since the pandemic). Despite all this, Musk is still staking the company’s future on his so-called Robotaxi rather than a cheaper offering. From Bloomberg:

The idea of creating an autonomous taxi service has been kicking around Tesla for at least eight years, but the company has yet to stand up much of the infrastructure it would need, nor has it secured regulatory approval to test such cars on public roads. For the moment, Musk has put off plans for a $25,000, mass-market vehicle that many Tesla investors — and some insiders — are pushing for and believe is crucial to the carmaker’s future.

In the wake of media reports on the strategic shift, key managers including Drew Baglino, an 18-year company veteran who headed Tesla’s powertrain engineering and energy business, have left.

Musk, 52, has steered Tesla out of many jams in the past. At $469 billion, the company is still valued at more than nine times the market capitalization of General Motors Co. or Ford Motor Co. But after losing almost $350 billion in market cap over four months, employees, investors and analysts alike are bewildered and second-guessing the company’s strategy.

“The stock will need to undergo a potentially painful transition in ownership base, with investors previously focused on Tesla’s EV volume and cost advantage potentially throwing in the towel,” Deutsche Bank analyst Emmanuel Rosner said last week, downgrading the shares from a buy and slashing his price target by more than a third.

Musk has signaled on his social media network that the recent moves amount to activating wartime CEO mode. He liked a post saying as much after sending a companywide email announcing that Tesla was cutting more than 10% of global headcount, which would mean eliminating at least 14,000 jobs.

The actual number of people ushered out may exceed 20,000, according to people familiar with the company’s planning. Musk’s reasoning, according to one person with direct knowledge of his edicts, was that Tesla should reduce headcount by 20% because its vehicle deliveries dropped by that amount from the fourth quarter to the first quarter.

Last week, Musk said the automaker was “going balls to the wall for autonomy,” meaning the robotaxi is taking precedence over a cheaper vehicle he first teased four years ago.

Musk has talked a big game about autonomy for over a decade, and has convinced customers to pay thousands of dollars for a product Tesla has marketed as Full Self-Driving, or FSD. The name is a misnomer — FSD requires constant supervision and doesn’t render vehicles autonomous — but Musk has repeatedly predicted it’s on the verge of measuring up to the branding. “I’m the boy who cried FSD,” he said in July.

Musk and top engineers are particularly bullish about a major change in how FSD now works. Cameras placed around the company’s cars are taking in video and using this footage to dictate how the vehicle drives, instead of relying on software code. Ashok Elluswamy, a director of Tesla’s Autopilot program, wrote on X last month that this should lead to “unprecedented progress.”

But optimism around FSD and Musk’s belief that this new approach could bring about robotaxis is clouding the future of Tesla’s $25,000 car project. People with knowledge of Tesla’s plans disputed the notion that the program has been canceled altogether. All along, the company has been pursuing a low-cost vehicle architecture that will underpin several different types of models, one of which would have no steering wheel or pedals.

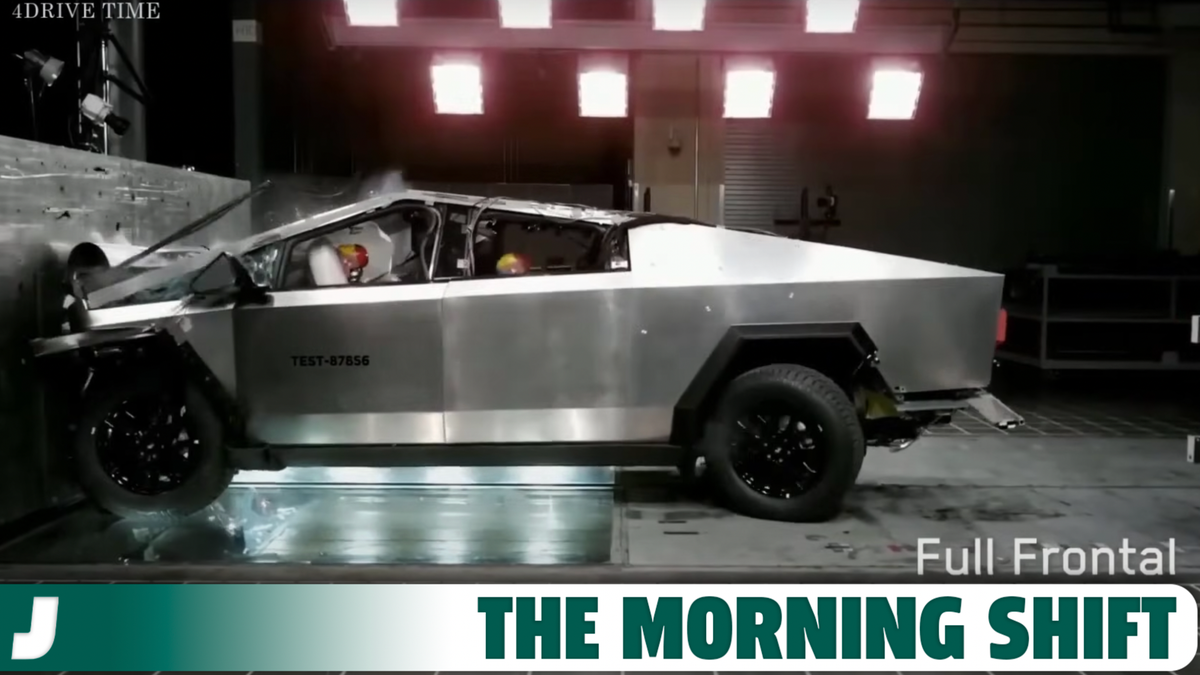

It’s unclear just how much solace this might be to investors who’ve been spooked by reports that Tesla’s answer to affordable options like the Toyota Corolla has been scrapped entirely. Many are concerned that the only new model the company will offer to consumers in the half decade after the Model Y’s debut will be the Cybertruck, an expensive pickup that’s difficult to build. Last week, the company recalled the almost 3,900 trucks it’s sold to fix faulty accelerator pedals.

“Investors, particularly institutional ones, are losing patience,” said Bloomberg Intelligence analyst Steve Man. “The initial hype around Full Self-Driving and robotaxis has waned, and the pendulum has swung in the opposite direction.”

No one can really be sure where Tesla is headed next. When you’ve got a CEO like Elon Musk, there’s not even a guarantee that his current fixation, the robotaxi, will actually get done.

It’s going to be a wild ride no matter what happens, folks.

2nd Gear: Tesla Cuts Car, FSD Beta Software Prices

Too much inventory and too few sales have forced Tesla to once again cut the prices of some of its vehicles in the U.S., Europe and China. The automaker also cut the price of its Full Self-Driving program by a third to just $8,000 in the U.S.

As we were just talking about, self-driving is a big focus of CEO Elon Musk and Tesla right now, so it makes sense the price would be cut to get folks excited about the idea of self-driving cars. From Bloomberg:

Tesla’s website says that customers will receive a 30-day trial of FSD with a new vehicle purchase. The currently enabled features “require active driver supervision and do not make the vehicle autonomous,” according to the company.

Earlier in the weekend, Tesla cut prices in China and the US, its two key markets, as well as in Europe, after disappointing first-quarter sales contributed to swelling inventory.

In China, Tesla lowered prices cross its range, with the revamped Model 3 falling to 231,900 yuan ($32,000) from 245,900 yuan previously. The Model Y was discounted to 249,900 yuan — or about $34,500 — from 263,900 yuan.

In the US, the cheapest version of the Model Y is now $42,990, returning the sport utility vehicle’s starting price to the lowest it’s been. Tesla also discounted the two other more expensive versions of the Model Y by $2,000, and dropped the price of the Model X to its lowest yet.

[…]

In China, Tesla’s market share shrank to around 6.7% in the fourth quarter of 2023, from 10.5% in the first three months of the year, according to Bloomberg calculations based on China’s Passenger Car Association data.

The automaker recently pared back production schedules at its Shanghai factory, Bloomberg reported late last month. Shipments from its Shanghai plant — which makes EVs for China and for export to other parts of Asia, Europe and Canada — declined in the first two months from a year earlier, even as overall passenger-vehicle sales in China increased.

Right now does not feel like a good time to be at Tesla. It’s just a hunch.

3rd Gear: Tesla U.S. Registrations Plunge 25 Percent In February

Tesla is very obviously the bellwether of the entire electric vehicle industry, so the fact that the automaker’s new vehicle registrations fell 25 percent in February compared to a year earlier means the entire segment was dragged into the red, according to S&P Global Mobility.

The last time Tesla’s U.S. vehicle registrations suffered a monthly decline was in August of 2020, but that was just a two percent drop. That was also the last time new EV registration in the U.S. fell as a whole, dropping six percent. That one makes sense. I mean, does anyone else remember the pandemic? From Automotive News:

The February numbers represent a reversal from years of double-digit percentage gains. Analysts have been warning for months that EV growth was cooling as mainstream buyers balked at elevated sticker prices and worried about driving range and charging infrastructure.

Total EV registrations fell 2.8 percent in February to 78,361, according to S&P’s data, the most recent available. Electric vehicle share of the U.S. light-vehicle market fell to 6.2 percent from 7 percent in February 2023.

Ed Kim, chief analyst at AutoPacific, said the EV segment is coming down off of a sugar high from early adopters willing to pay premium prices for the new technology in recent years.

“Cost is a massive factor, and there just isn’t a lot of choice below $35,000 for consumers at mainstream price points,” Kim said. “A lot of the affluent early adopters who wanted an EV now have one.”

So, Tesla may still be down for the month, but it is still by far and away the number one EV seller in the U.S. 36,697 Teslas were registered in February. That’s nearly 30,000 more EVs than were registered by the second-place automaker: Ford. Hyundai/Kia, BMW and Rivian rounded out the top five for the month.

Even though they were way behind, all of those automakers saw sharp increases over February 2023, so good for them, I suppose.

Also, Tesla’s fall came mostly from the Model 3, with a 73 percent drop in February. The sedan lost its $7,500 federal incentive on Jan. 1, and Tesla introduced a freshened version into its California factory in the first quarter, which likely constrained supply, analysts said.

Tesla’s most popular vehicle, the Model Y crossover, was down 6.7 percent in February registrations despite aggressive discounts and eligibility for the $7,500 federal tax incentive.

Without Tesla, EV sales were up 32 percent. That sounds good, but EVs are still losing market share to hybrid vehicles.

“You have a higher share for hybrid and it’s growing faster than EV,” Libby said. Hybrids had a 10.8 percent share of the light-vehicle market in February, a gain of 3.4 percentage points year over year. Hybrids offer partial electrification at similar prices to gasoline vehicles, he said.

Kim doesn’t see a return to strong EV growth until the products better match consumer preferences and budgets, likely in a couple of years.

“The longer-term solution is automakers developing mainstream-priced EVs that consumers want,” Kim said. “That’s necessary to get EV adoption rates back on track.”

Basically, everyone who really wanted an EV now has one, and the stuff that is being offered right now, especially by Tesla, is not resonating with less affluent and more skeptical consumers. Surely the Robotaxi will fix this.

4th Gear: A Massive Win For The UAW

Good news, folks. We’re not only talking about Tesla today. No, sir. We are also talking about a huge win for organized labor! Workers at Volkswagen’s Chattanooga, Tennesse plant have voted to join the United Auto Workers union. It’s the first automaker to join the union outside of the Big Three domestic automakers.

A majority of eligible workers voted in favor of the union, and the final tally was 2,628 to 985. That means 73 percent favored joining the UAW union. From Reuters:

The landslide win will make the Chattanooga factory the first auto plant in the South to unionize via election since the 1940s and the first foreign-owned auto plant in the South to do so.

It is also a huge shot in the arm for UAW President Shawn Fain’s campaign to unionize plants owned by more than a dozen automakers across the U.S., including Tesla Fain, known for his aggressive bargaining tactics, and his team have committed to spending $40 million through 2026 on the effort.

Jubilant workers, some in tears, raised their arms in victory and held aloft “Union Yes” posters as the final tally came in.

“I’m exhilarated that we actually accomplished what we set out to accomplish,” said VW employee Lisa Elliott as she hugged her coworkers. “Tell Mercedes they’re next,” she cheered.

In less than a month on May 13, Mercedes-Benz workers in Alabama will vote on whether or not to join the United Auto Workers union.

As it turns out, the third time’s the charm. The UAW narrowly lost votes at the same VW plant in 2014 and 2019.

Reverse: That’s Right, Bozo. USA USA USA

Neutral: More Proof Convertibles Are The Best

I saw this guy driving around in the South of France. They are my new hero, and if this isn’t proof convertibles are the best body style in the world, I don’t know what is.