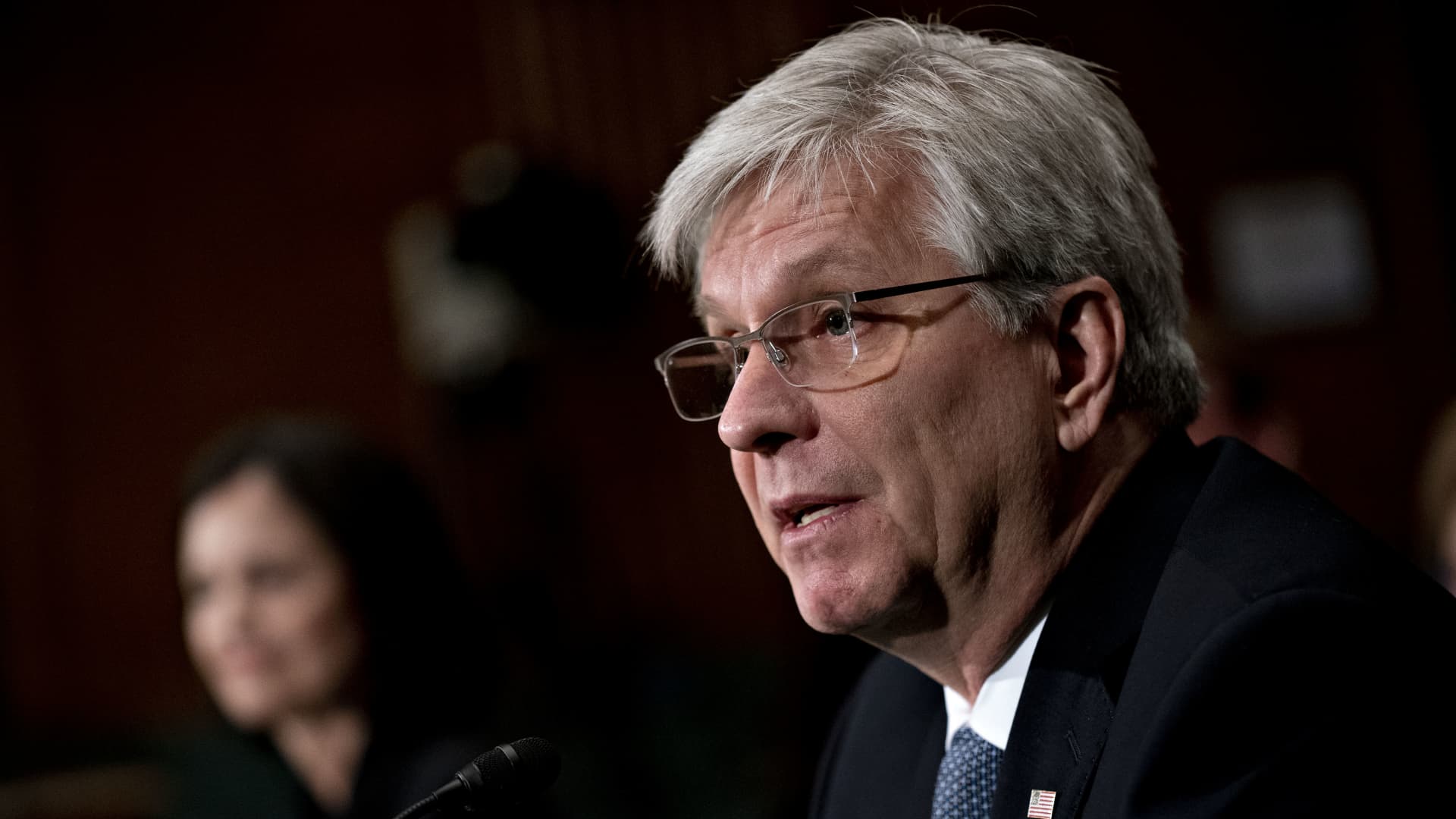

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks during a Senate Banking Committee confirmation hearing in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Images

My top 10 things to watch Thursday, March 28

1. The final trading day of the month and the first quarter — the glorious rally that you missed if you only cared about the Federal Reserve. While the futures are flat this morning, the S&P 500 is pacing for its best first-quarter performance since 2019. Fed Governor Christopher Waller on Wednesday said recent disappointing inflation data means the central bank is “in no rush” to cut interest rates. We are going higher for longer which means you want to own Wells Fargo.

2. HSBC chose to raise its price targets on several financials: Club stock Morgan Stanley to $100 from $96 to $100 (Club name); Goldman Sachs to $460 from $432; Citigroup to $70 from $61; JPMorgan to $205 from $188; Club name Wells Fargo to $60 from $55. Meanwhile, it upgraded PNC Financial to hold from sell and downgraded Bank of America to hold from buy.

3. Walgreens on Thursday reported a huge quarterly revenue beat: $37.05 billion vs. $35.86 billion expected. However, the retail pharmacy’s U.S. healthcare segment posted an operating loss of $13.1 billion due to a steep impairment charge related to its primary care provider VillageMD. Real earnings per share: $1.20. The company also lowered the high end of its full-year adjusted earnings guidance due to the challenging retail environment. Shares of WBA dipped 1.6% in the premarket.

4. RH‘s fourth-quarter sales and EPS missed Wall Street expectations, but the luxury home goods retailer forecast stronger better-than-expected revenue growth for 2024 due to increasing demand. At last, a jubilant Gary Friedman, RH’s chairman and CEO. It’s still the worst housing market in 30 years … JPMorgan raised its price target on RH shares to $345 from $329, while Baird went to $300 from $280, and BofA lifted to $375 from $360.

5. Estee Lauder is a Club holding that has been awful. BofA said earnings have bottomed. The cosmetics company moved into Amazon’s Prime Store and is working through its excess inventory at last. That reduces reliance on China and travel retail. This is why we held it through a halving of the estimates. BofA upgraded shares to buy from hold and raised its PT to $170 from $160. Shares rose more than 3% in premarket trading.

6. ICYMI: I shared my outlook for stocks heading into the second quarter at our March Club meeting on Wednesday, including the 3 things I need to see before buying a stock in this bull market. We also shared our latest thinking on each of our 33 portfolio stocks.

7. MoffettNathanson said to stay with DraftKings as there is free cash flow coming despite a potential NCAA player prop ban and regulators exploring raising New Jersey online gaming tax rates. The firm raised its PT to $55 from $52 and kept its buy rating.

8. Vornado Realty Trust, an office-focused real estate investment trust, upgraded to a hold-equivalent rating from sell at Morgan Stanley. They like SL Green, too. Near the end of the CRE crash?

9. A round of price-target cuts for United Parcel Service, including from analysts at Stifel, HSBC and TD Cowen. I think this is fallout from losing customers to FedEx, the ones who used to be UPS but moved their business due to uncertainty around last year’s UPS-Teamsters labor talks.

10. Analysts giving love to Kimberly-Clark after its investor day. Price target bumps at Piper Sandler ($152 from $145) and HSBC ($146 from $134), while Evercore ISI upgraded the Kleenex maker to a buy-equivalent rating from in line. I really like Kimberly-Clark’s restructuring; gives local management more say and cuts costs.

Sign up for my Top 10 Morning Thoughts on the Market email newsletter for free

(See here for a full list of the stocks at Jim Cramer’s Charitable Trust.)

As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade.

THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY, TOGETHER WITH OUR DISCLAIMER. NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.