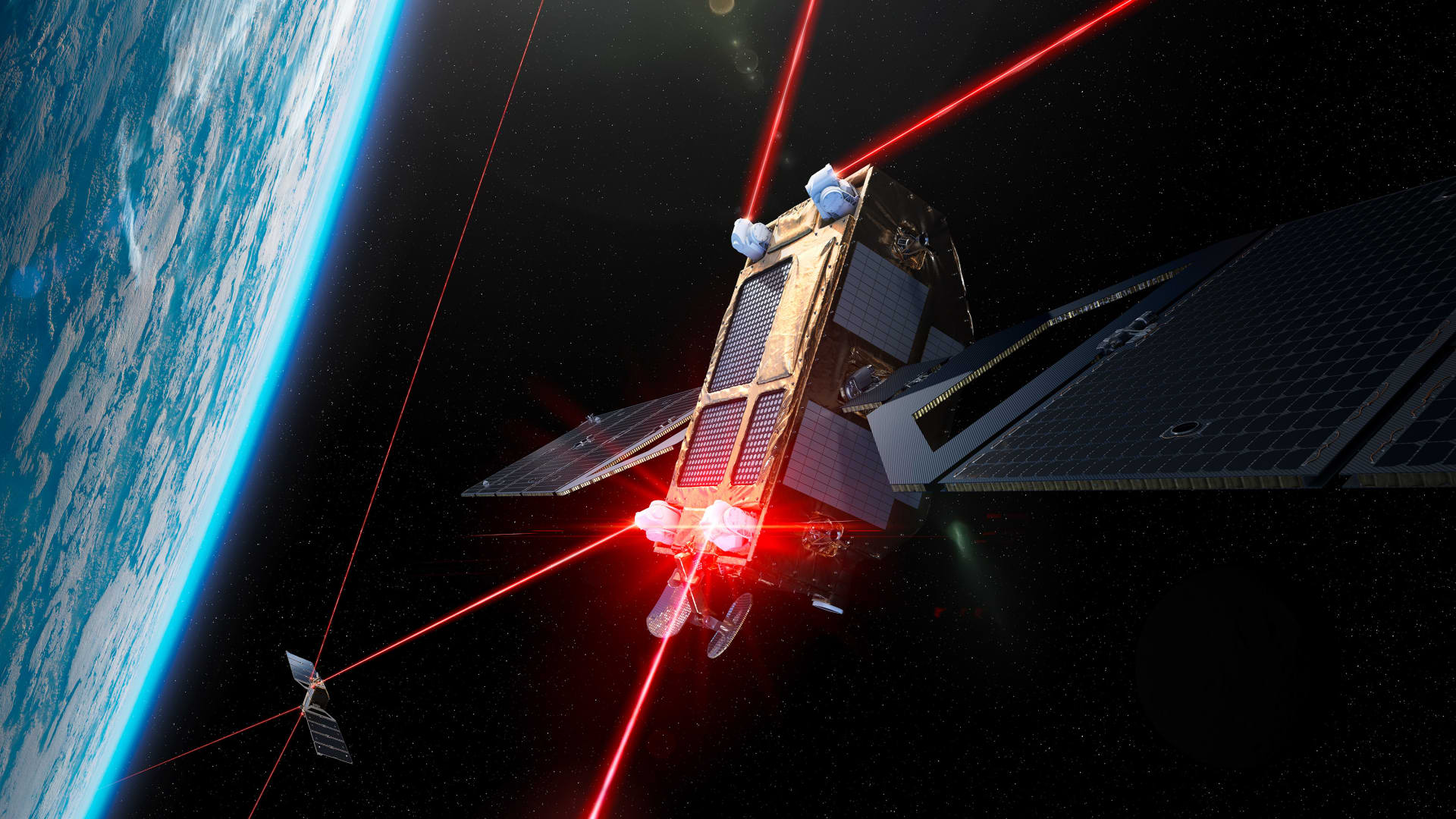

A rendering of the company’s laser communications system on satellites in orbit.

Mynaric

CNBC’s Investing in Space newsletter offers a view into the business of space exploration and privatization, delivered straight to your inbox. CNBC’s Michael Sheetz reports and curates the latest news, investor updates and exclusive interviews on the most important companies reaching new heights. Sign up to receive future editions.

Overview: The space railroad

Another year, another SpaceX market expansion.

“We are going to roll out a capability, we call it ‘plug and plasers,'” Shotwell said at an industry conference.

Selling its OISL terminals to other companies marks the latest scaling of SpaceX’s products and services. What started out as a transportation company – delivering satellites, cargo and crew to space on its rockets – has since grown into a broader infrastructure venture with the addition of its rideshare, satellite communications and imagery, and hosted payloads businesses.

But none of this is a surprise, argues Abhi Tripathi, former SpaceX director of the Commercial Crew and Cargo program and now a director at UC Berkeley’s Space Sciences Lab.

“There’s nothing of all the services that you just described, that SpaceX hasn’t already told you it was going to go after a long time ago,” Tripathi told me this week.

Starlink? Needed as a moneymaker to fund the path to Mars and then create the same type of communications network around that planet. Rideshare? Just “squeezing more spacecraft” onto their rockets. Hosted payloads and satellite imagery? Tacking on capabilities to its Starlink satellite platform.

“Unlike many companies, they don’t go chasing revenue. They tell you exactly what they’re going to build and then they will maximize revenue from that thing, whatever it is that they built,” Tripathi said.

For the OISL market, Tripathi explained the decision of selling to other spacecraft operators who need a way to get their data back from orbit but want to do that as cheaply as possible – rather than build new ground stations on Earth or wait to connect to existing ones.

“They can say to a potential customer: “Hey, we have an internet backbone we just put up in space that’s laser fast. I am going to lower your barrier to entry of joining and using my laser link network by providing you an [OISL] terminal that will allow you to share data,” Tripathi said.

But the OISL marketplace isn’t exactly vacant. Mynaric is a pure-play space company that has been focused on building these space lasers, particularly winning contracts to supply defense contractors’ satellites such as under the Pentagon’s SDA program.

I spoke to Mynaric CEO Mustafa Veziroglu for his take on SpaceX’s entrance into the OISL market. He was unfazed, saying “we don’t see them as competitors.”

“From our perspective, it’s not something that I was surprised about … it really ties into their strategy, which is they’re not really looking to sell terminals for business, they’re trying to connect to their constellation. To do that, you need compatible terminals,” Veziroglu said.

More broadly, Tripathi pointed to SpaceX’s commercialization of its space laser business as an example of how startups should think about entering the industry, making the analogy that SpaceX is a railroad.

“They are laying track. You could decide you want to get in the track-laying business, or you could decide what you want to put on that track. I always tell people, ‘Don’t fight to build another railroad. Try to make your product maximize use of the railroad,'” Tripathi said.

What’s up

- SpaceX is building spy satellites under an NRO contract, a $1.8 billion Starshield deal signed three years ago with the National Reconnaissance Office. The system is described as hundreds of imagery satellites that operate in low Earth orbit, similar to SpaceX’s Starlink communications network. About a dozen prototype satellites have been reportedly launched since 2020. In response, China called the SpaceX and NRO project as exposing the U.S. for “shamelessness and double standards.” – Reuters / Reuters

- Rocket Lab’s Electron launches NRO mission, the company’s fifth mission to date for the spy agency and the first to launch from its Virginia pad. – Rocket Lab / NRO

- The next Starship flight won’t carry satellites: SpaceX President and COO Gwynne Shotwell said at an industry conference that the company expects to launch the next Starship test flight as soon as six weeks from now, because SpaceX is focused “on getting reentry right and making sure we can land these things where we want to land them.” – SpaceNews

- Senators are introducing new bills on space regulations, aimed at speeding up the process of approving new satellites and signing off on rocket launches. – Bloomberg / Cornyn

- California legislators want further state investment in space, pointing to the efforts of Florida and Texas to foster the sector’s economic growth. – Carbajal

- Boeing begins fueling Starliner for crew flight test, entering into the final stages of preparing the capsule to fly astronauts to the ISS for the first time. – Boeing

- SDA is ‘reevaluating’ Raytheon’s $250 million contract under the PWSA, but the agency declined to specify why the company will no longer deliver seven sensor satellites for the network’s Tranche 1 Tracking Layer. – SpaceNews

- NASA points to progress of Blue Origin’s Orbital Reef space station, saying the company “recently completed testing milestones for its critical life support system” and passed four milestones under the agency’s agreement. – NASA

- Globalstar is reportedly in testing with Walmart, after the satellite communications operator previously said it signed a $1.5 million deal “with one of the world’s largest retailers.” – Light Reading

Industry maneuvers

- Intelsat is paying Eutelsat $250 million for OneWeb network capacity, a six-year deal that also has an additional $250 million option. The deal is an expansion of the satellite groups’ previous agreement, which was for $45 million. – Intelsat

- European Space Agency announces $254 million (€233 million) contract to trio of companies for low Earth orbit (LEO) satellites under the “FutureNAV” program. OHB Italia is leading a consortium to develop the “Genesis” satellite for use with navigation and science systems, while GMV Aerospace and Defense with OHB System and Thales Alenia Space will build a pair of PNT (Positioning, Navigation, and Timing) satellites. – ESA

- Europe buys pair of Falcon 9 launches for $196 million (€180 million), after the European Union signed off on the deal to launch four Galileo satellites after delays to Arianespace’s Ariane 6 rocket. – Politico

- Viasat expands in-flight WiFi deal with Korean Air, with the company planning to equip 40 of the airline’s Boeing 787 aircraft after previously signing to equip 30 of its Airbus A321Neos, all of which are expected to be in service by the end of 2027. – Viasat

- Pentagon’s DIU selects three companies for space tug missions: Blue Origin is developing the Dark-Sky-1 mission for launch on its Blue Ring platform, Northrop Grumman’s SpaceLogistics is working on a use of its in-space refueling tech for an upcoming mission, and Spacebilt is working on an in-space assembly and manufacturing project. – Defense Innovation Unit

- DIU also selected Firefly for a space tug study, looking to see if the company’s Elytra vehicles can support demo missions beyond Geosynchronous orbit. – Firefly

- Astranis sells satellite to Argentinian provider Orbith, representing the fifth and final order from the company’s third batch of satellites. – Astranis

- Xona Space orders satellite from Belgium-based Aerospacelab: The pair of startups will work together to bring Xona’s first positioning, navigation and timing (PNT) satellite to life, which is expected to be built at a facility in the U.S. – Aerospacelab

- Orbit Fab is selling satellite refueling ports for $30,000 a piece and announced the flight qualification of its docking mechanism after completing testing. The company expects to produce about 100 of the RAFTI (Rapidly Attachable Fluid Transfer Interface) fueling ports for customers this year. – Orbit Fab

- DARPA selects Northrop Grumman for ‘moon-based railroad network’ under the LunA-10 project, which is the Defense Advanced Research Projects Agency’s effort to create a lunar infrastructure architecture. Northrop said its concept “could transport humans, supplies and resources for commercial ventures across the lunar surface.” – Northrop Grumman

Market movers

- Intuitive Machines reports Q4 results and recently-improved cash position, which it noted is its “largest balance relative to any quarter-end since the Company’s IPO.” Net income and revenue both fell on a year-over-year basis for the fourth quarter, but Intuitive Machines said its improved backlog and upcoming contract opportunities put the company in “a position of financial strength.” It still aims to launch a second cargo moon mission later this year. – CNBC

- Spire stock surges 40% after Nvidia partnership, with the satellite company set to integrate its weather prediction data into the NVIDIA Earth-2 platform that the companies proclaim will “usher in a new era of accuracy in weather forecasting.” – Spire

- Spire looks to raise $30 million in a common stock offering through two institutional investors, for use in repaying debt and other corporate purposes. – Spire

Boldly going

- Steve Clarke, Jim Reuter, Michael Gazarik, and Frank Peri join Astrobotic: Clarke was named the moon company’s Director of Landers and Spacecraft, having previously been a senior NASA official. Reuter, Gazarik, and Peri – also all former NASA leaders – are joining Astrobotic’s advisory board. – Astrobotic

- Melanie Stricklan named Executive Director of ‘Space Workforce 2030,’ a coalition of companies created by the Aerospace Corp, and now joined in leadership with the Space Foundation. The initiative aims “to cultivate and empower a diverse, skilled workforce capable of leading the space industry into the future,” wrote Stricklan, who previously was the CEO of startup Slingshot Aerospace before departing last year. – Stricklan

Ad astra

- Thomas Stafford, 93, dies after extended illness: The former NASA astronaut flew to the moon and led the groundbreaking Apollo-Soyuz mission, the first joint spaceflight between the U.S. and the Soviet Union in 1975. In a statement, NASA Administrator Bill Nelson heralded Stafford as an explorer, peacemaker, gentleman, and daredevil. – NASA

On the horizon

- Mar. 21: SpaceX Falcon 9 launches CRS-30 cargo mission to the ISS from Florida.

- Mar. 22: NASA and Boeing press conferences for Starliner crew flight test.

- Mar. 22: SpaceX Falcon 9 launches Starlink satellites from Florida.

- Mar. 25: SpaceX Falcon 9 launches Starlink satellites from Florida.

- Mar. 27: SpaceX Falcon 9 launches Starlink satellites from California.