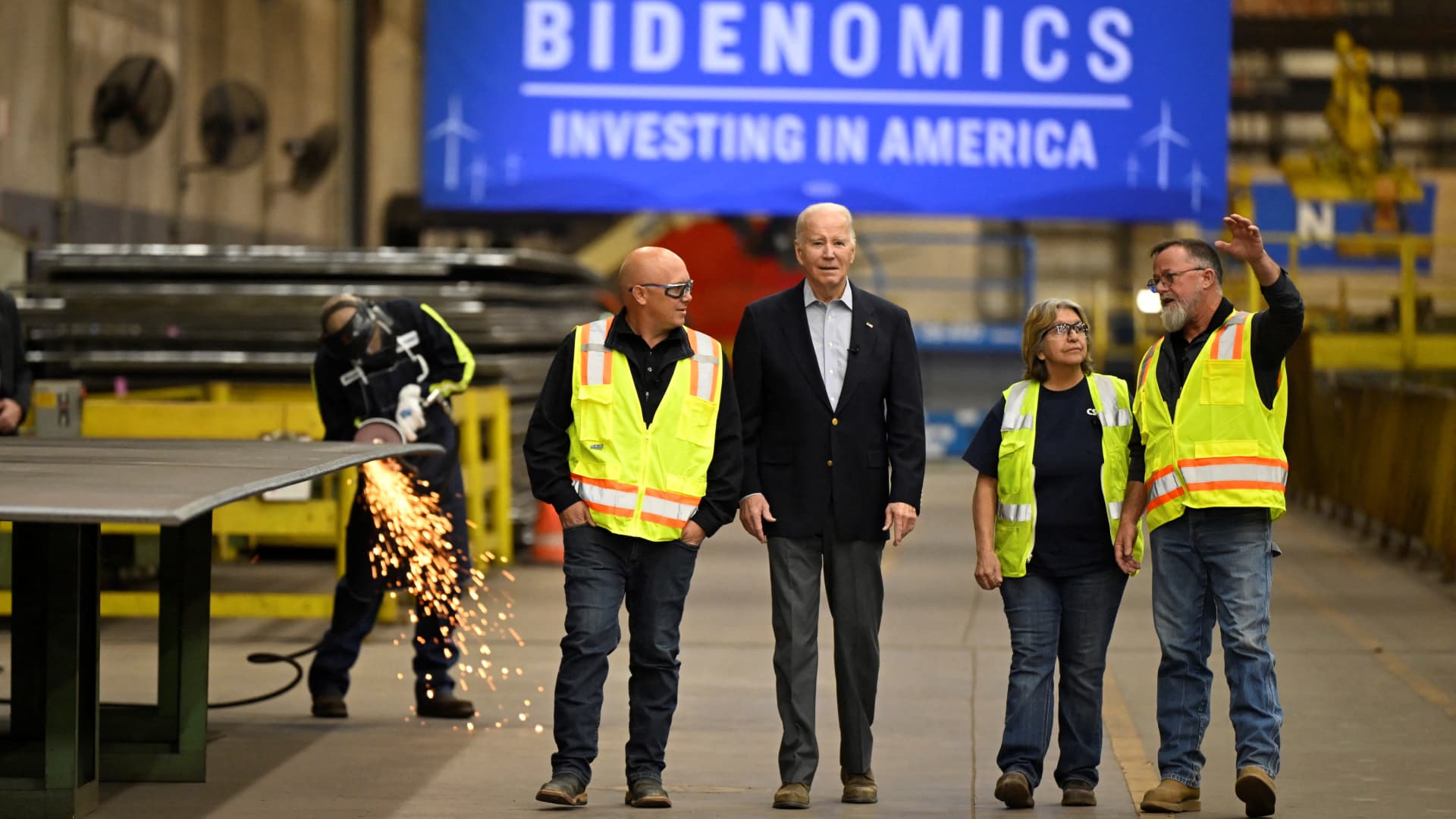

U.S. President Joe Biden speaks with workers while visiting CS Wind, the largest wind tower manufacturer in the world, in Pueblo, Colorado, U.S., November 29, 2023.

Andrew Caballero-Reynolds | AFP | Getty Images

This report is from today’s CNBC Daily Open, our international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Tesla shares plunge 12%

Shares of electric vehicle maker Tesla plunged 12%, their biggest drop in over a year. The move came a day after the company’s earnings missed expectations and it warned of a slowdown in 2024. Tesla’s stock also came under pressure from various brokers, who reduced their price targets for the company.

Apple opens iPhone store in Europe

Apple plans to open up its iPhone App Store in Europe to competitors. This move opens up cracks in the company’s famous “walled garden,” with which it controls app distribution on its devices. This was in response to a new European law, the Digital Markets Act, which forces big tech companies to open up their platforms by March of this year.

Lagarde responds to scathing survey

Christine Lagarde said she was “proud and honored” to lead the European Central Bank, after her leadership was criticized in a union-run survey of staff. Lagarde went on to say that the ECB’s own surveys suggested people were happy to work at the central bank and had a sense of mission.

[PRO] Buy or avoid China?

Is it time to get into China markets? Some investors have been wary since Beijing has been struggling with a property debt crisis that has triggered financial risks across the broader economy. The Pro analysts give their take.

The bottom line

What recession?

The U.S. economy grew at an accelerated pace in the final three months of 2023, capping the year on a solid note.

And the recession that so many forecasters had predicted never happened.

The latest GDP data showed the economy grew at a rate of 3.3% in the fourth quarter, much higher than Wall Street’s estimates.

The numbers underlined the U.S. economy’s remarkable resilience in the face of sustained efforts from the Fed to aggressively hike interest rates to fight inflation.

The Biden administration wasted no time in attempting to claim credit. U.S. Treasury Secretary Janet Yellen said government policies helped boost the economy.

“Though some forecasters thought a recession last year was inevitable, President Biden and I did not,” Yellen said in a speech.” Instead of contracting, the economy has continued to grow, driven by American workers and President Biden’s economic strategy.”

“Put simply, it’s been the fairest recovery on record,” Yellen added.

Thursday’s report also included good news on the inflation front. The core personal consumption expenditures price index posted a quarterly gain of 2%, excluding food and energy — a key gauge the Fed uses when assessing inflation. Headline inflation increased just 1.7%.

With all the data pointing in the right direction, it looks like the economy could be inching close to the much talked about soft landing, if it hasn’t already.

— CNBC’s Jeff Cox contributed to this report.