Trian Partners co-founder and major Disney shareholder Nelson Peltz formally launched his battle for board seats Thursday — pushing for the right kinds of changes to fix the entertainment giant’s problems and lagging stock price. Trian officially nominated Peltz and former Disney CFO Jay Rasulo as directors for consideration at the company’s upcoming annual meeting. Disney put forward its own slate Tuesday — and as expected, nominated former Morgan Stanley CEO James Gorman, among others, while rejecting Peltz and Rasulo. Despite selling half its stake at $113 per share in early 2023, Trian is still the biggest active Disney shareholder when considering it also controls former Marvel Entertainment Chairman Ike Perlmutter’s stake. Trian oversees about $3 billion worth of Disney stock. In Trian’s preliminary proxy statement, Peltz said Disney’s board has failed to hold CEO Bob Iger and management accountable for missteps and failed to offer and drive strategic solutions. Trian pointed out that Disney’s earnings per share in its most recent fiscal year were lower than a decade ago and more than 50% below peak EPS despite over $100 billion of capital invested. Disney’s total shareholder return significantly underperformed rival companies and the S & P 500 , according to Trian. Peltz argued his case Thursday morning on CNBC — doubling down on his concerns ranging from poor corporate governance, persistent streaming losses, uncertainty about the future of ESPN, continued failures at the box office, and lack of tangible targets around parks. “This company is just not being run properly. The board oversight is awful,” the activist investor told Jim, who agrees. The stock’s terrible track record reflects this oversight issue, and we’ve felt this pain as long-time shareholders. DIS 5Y mountain Disney 5 years However, we now question, along with Peltz, whether the board has enough skin in the game — meaning stock ownership among its members— and if it understands just how terrible the share performance has been. Adding Peltz and Rasulo would change the dynamic in the boardroom, making the directors more accountable to the shareholders they work for. “The stock has been horrible and continues to be,” Jim said Thursday. “Maybe they need Nelson Peltz in there. He’s done very good things when he gets into a room.” Peltz and Trian have a history of working with companies across industries and getting results. In March 2018, Peltz joined the board of Procter & Gamble — a relationship that led to market share gains and improved financial performance. We thought Disney was going in the right direction last quarter after delivering a solid free cash flow outlook for fiscal year 2024 along with aggressive cost savings. We were also encouraged by the knowledge-sharing agreement with activist investor group ValueAct, to consult with the company on strategic matters. While these were important milestones, there’s still a sense the company has more work to do — especially with improving subpar margins in its streaming business, which is the key to getting the stock higher. To be sure, Iger has moved to aggressively cut costs to improve efficiencies. At the same time, he received a major pay increase in 2023 to $31.6 million — more than double his prior-year compensation. Peltz has been pushing Disney board representation since the beginning of 2023 . In a CNBC interview with Jim last February, the Trian boss called off his proxy fight after he liked what he heard from Iger who had just returned as CEO in November 2022. Iger was hastily reinstalled following the abrupt firing of his handpicked successor Bob Chapek who wasn’t able to right the ship. Now, nearly a year later, Peltz renewed his pursuit of board seats, telling CNBC he believes that Iger has not moved quickly enough and Disney’s stock price has only gone down over the past year. Among the fixes outlined in Trian’s filing Thursday are to “complete a successful CEO succession; and align management pay with performance,” achieve Netflix -like margins in streaming, and target “at least high-single-digit operating income growth” at parks to ensure adequate return capital expenditures. (Jim Cramer’s Charitable Trust is long DIS, PG. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

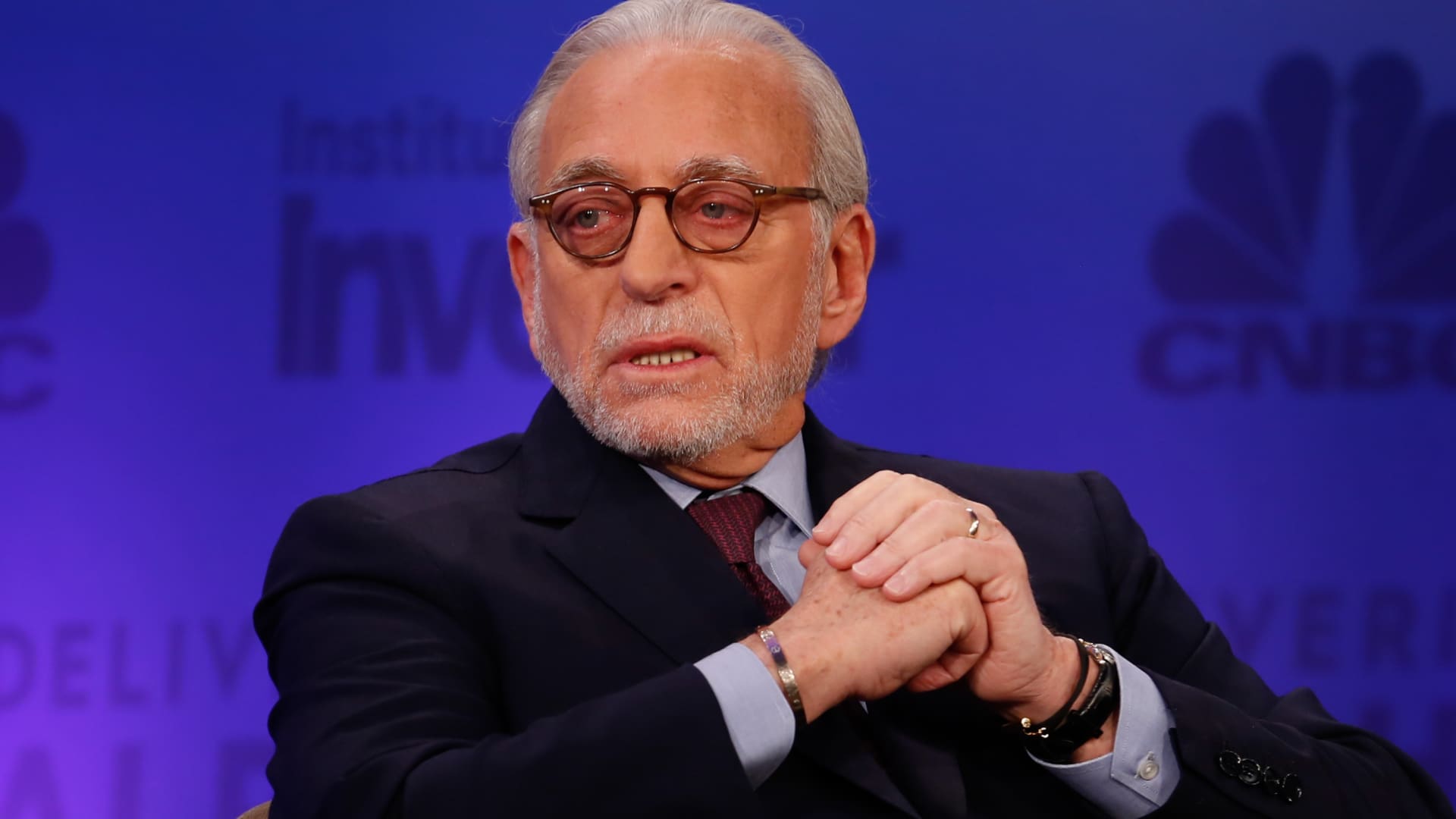

Nelson Peltz at Delivering Alpha 2015 in New York.

David A. Grogan | CNBC

Trian Partners co-founder and major Disney shareholder Nelson Peltz formally launched his battle for board seats Thursday — pushing for the right kinds of changes to fix the entertainment giant’s problems and lagging stock price.

Denial of responsibility! Secular Times is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – seculartimes.com. The content will be deleted within 24 hours.