Introduction: “Surprising” acceleration in house price growth

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices growth has “surprisingly” picked up to a two-year high, a new survey this morning shows, despite the recent rise in mortgage rates.

The average prices of a house sold in November rose by 1.2% compared with October, lender Nationwide reports, to £268,144. That’s the largest monthly gain since March 20.

That lifts the annual increase in house prices to 3.7% – the fastest since November 2022, shortly after Liz Truss’s mini-budget – up from 2.4% in October.

House prices are just 1% below the all-time high recorded in the summer of 2022.

Robert Gardner, Nationwide’s chief economist, says the pace of the increase is unexpected:

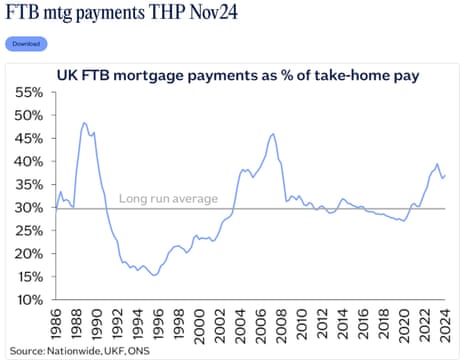

“The acceleration in house price growth is surprising, since affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels.

Housing market activity has remained “relatively resilient in recent months”, Gardner adds, with mortgage approvals approaching the levels seen before the Covid-19 pandemic.

Gardner adds:

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year. Household balance sheets are also in good shape with debt levels at their lowest levels relative to household income since the mid-2000s.

Nationwide also predicts there will be a jump in transactions in the first three months of 2025. as buyers try to seal deals before changes to stamp duty kick in next April.

These surveys from lenders can’t give a perfect measure of the market though; they only track buyers taking out a mortgage, rather than cash buyers. And changes in the ‘mix’ of houses being sold can also distort the data.

The agenda

-

9am GMT: Eurozone manufacturing PMI report for November

-

9.30am GMT: UK manufacturing PMI report for November

-

10am Christine Lagarde speaks at the EIB Group Climate and Environment Advisory Council in Luxembourg

-

2.45pm GMT: US manufacturing PMI report for November

Key events

House price growth rises: what the experts say

Here’s some reaction to this morning’s Nationwide house price report:

Guy Gittins, CEO of Foxtons:

“After the rate of house price growth slowed in the lead up to the Autumn Budget, the latest figures suggest the market is once again starting to accelerate.

This consistent positivity demonstrates the current strength of the market despite the complications posed by wider economic headwinds. Over the last 12 months we’ve seen a huge increase in new buyer volumes, viewings and offers made and there is a very healthy level of stock currently on the market. So, whilst house prices are climbing, there is certainly a good level of stock for buyers to choose from and the market isn’t overheating due to the usual supply and demand imbalance.

The market traditionally pauses for breath during the festive period, however, we’re seeing a flurry of activity driven by buyers looking to secure stamp duty relief before next April’s deadline. We anticipate the start of next year to be much the same, although those buyers who are looking to take advantage of current stamp duty relief thresholds need to be acting now to stand a chance of completing in time.

Matt Thompson, head of sales at Chesterton:

“November’s property market saw an increasing number of first-time buyers who were and still are motivated to purchase a property before the stamp duty changes in April 2025. This, in addition to high demand from house hunters in general, led to more sales being finalised than in November of last year.

With the current level of buyer activity expected to continue well into the new year, we predict London properties to hold their value or see a gradual value increase of up to 3% over the course of next year.”

Tomer Aboody, director of specialist lender MT Finance:

“Another month of house price growth further indicates the level of confidence in the market which has been evident since the reduction and stability in both mortgage rates and inflation.

“Both sellers and buyers are pushing to transact, as affordability is improving.

“While the Budget is now behind us, its full impact has yet to be felt. However, we are hopeful that this confidence in the market continues, with further rate cuts expected in the new year.”

Jeremy Leaf, north London estate agent:

“In our offices we are seeing prices hardening and stock levels rising, partly because the Budget, though not particularly helpful, was not as bad as many feared either.

“As a result, some pent-up demand was released and buyers are digging a little deeper. That extra choice, as well as broad acceptance that inflation and mortgage rates will not reduce as far and as fast as many expected, has meant caution still prevails. Transaction lengths are extending too, particularly bearing in mind the seasonal distractions so sellers still need to be extra competitive to attract serious attention at this time of year.”

Dollar rallies after Trump’s Brics tariff threat

The US dollar is rallying, after Donald Trump warned countries in the Brics bloc that he would impose 100% tariffs if they challenged America’s currency.

Over the weekend, Trump posted that he would impose 100% tariffs on Brics members if they create a new currency to rival the US dollar.

The president-elect declared:

We require a commitment from these Countries that they will neither create a new BRICS Currency, nor back any other Currency to replace the mighty U.S. Dollar or, they will face 100% Tariffs, and should expect to say goodbye to selling into the wonderful U.S. Economy.

With fears of a trade war rising, the dollar has gained 0.5% against a basket of major currencies – even though there’s no agreement among Brics members to go it along with their own currency.

This has pushed the pound down by half a cent to $1.2695.

The euro, which is also weighed down by political instability in France, is also half a cent lower at $1.052.

Trump’s comments may be a sign that his administration will favour a stronger dollar.

Jim Reid of Deutsche Bank told clients this morning

As ever with Mr Trump it seems to be a shot across the bows but likely wouldn’t ultimately be great for the US economy if implemented….

it seems to further point to Dollar strength being a theme of the new administration as against Trump 1.0 where initially they tried to talk the Dollar down.

Introduction: “Surprising” acceleration in house price growth

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices growth has “surprisingly” picked up to a two-year high, a new survey this morning shows, despite the recent rise in mortgage rates.

The average prices of a house sold in November rose by 1.2% compared with October, lender Nationwide reports, to £268,144. That’s the largest monthly gain since March 20.

That lifts the annual increase in house prices to 3.7% – the fastest since November 2022, shortly after Liz Truss’s mini-budget – up from 2.4% in October.

House prices are just 1% below the all-time high recorded in the summer of 2022.

Robert Gardner, Nationwide’s chief economist, says the pace of the increase is unexpected:

“The acceleration in house price growth is surprising, since affordability remains stretched by historic standards, with house prices still high relative to average incomes and interest rates well above pre-Covid levels.

Housing market activity has remained “relatively resilient in recent months”, Gardner adds, with mortgage approvals approaching the levels seen before the Covid-19 pandemic.

Gardner adds:

“Solid labour market conditions, with low levels of unemployment and strong income gains, even after taking account of inflation, have helped underpin a steady rise in activity and house prices since the start of the year. Household balance sheets are also in good shape with debt levels at their lowest levels relative to household income since the mid-2000s.

Nationwide also predicts there will be a jump in transactions in the first three months of 2025. as buyers try to seal deals before changes to stamp duty kick in next April.

These surveys from lenders can’t give a perfect measure of the market though; they only track buyers taking out a mortgage, rather than cash buyers. And changes in the ‘mix’ of houses being sold can also distort the data.

The agenda

-

9am GMT: Eurozone manufacturing PMI report for November

-

9.30am GMT: UK manufacturing PMI report for November

-

10am Christine Lagarde speaks at the EIB Group Climate and Environment Advisory Council in Luxembourg

-

2.45pm GMT: US manufacturing PMI report for November