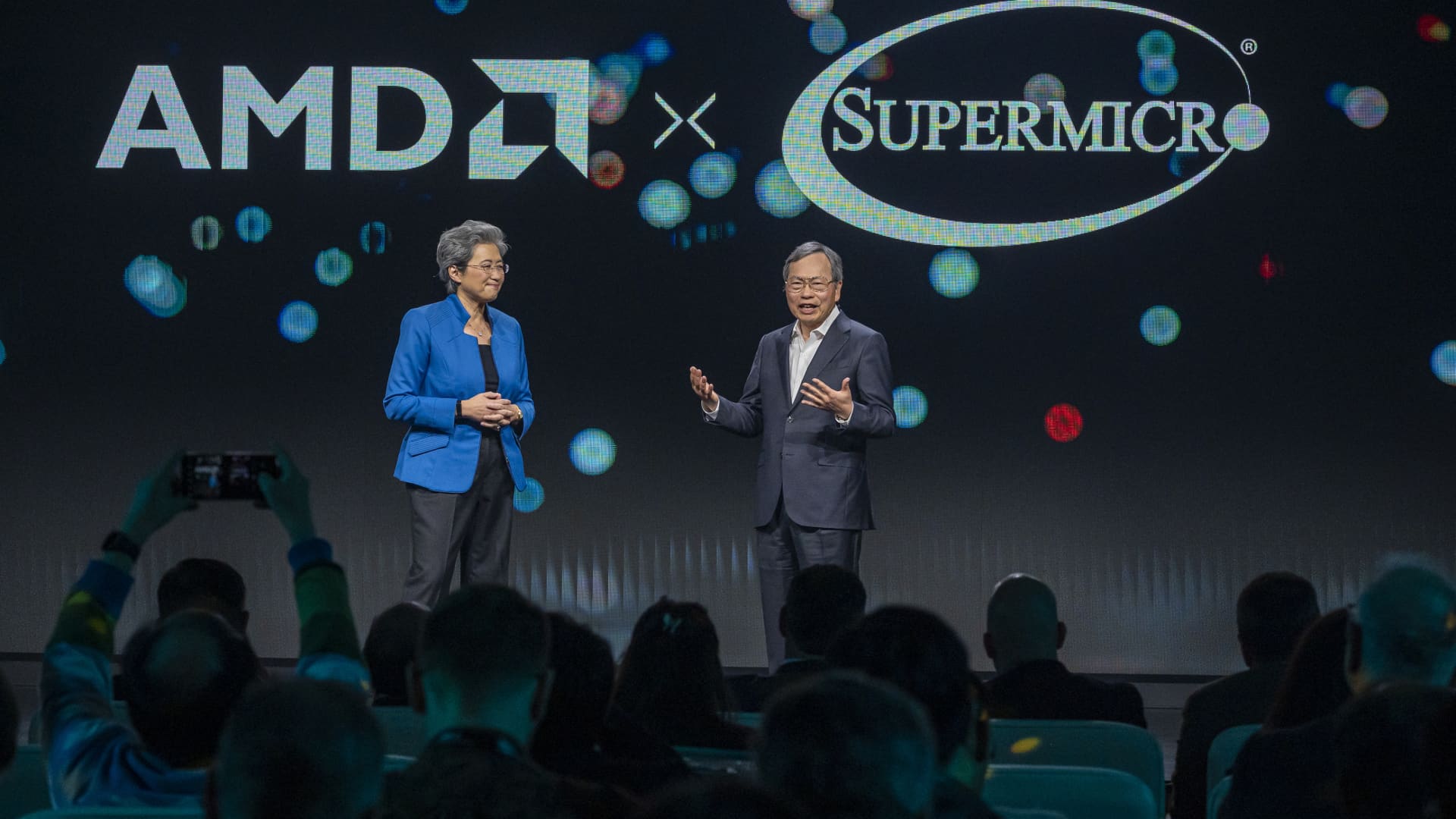

Lisa Su, chair and CEO of Advanced Micro Devices, left, and Charles Liang, CEO of Super Micro Computer, speak at the AMD Advancing AI event in San Jose, California, on Dec. 6, 2023.

David Paul Morris | Bloomberg | Getty Images

Super Micro shares slipped as much as 15% in extended trading on Tuesday after the server maker reported slightly less revenue than expected for its fiscal third quarter, even as it gave optimistic revenue guidance.

Here’s how the company did in comparison with LSEG consensus:

- Earnings per share: $6.65 adjusted, vs. $5.78 expected

- Revenue: $3.85 billion, vs. $3.95 billion expected

The company’s revenue jumped 200% year over year in the quarter, which ended on March 31, according to a statement. That compared with a 103% year-over-year increase in the previous quarter. Net income came out to $402.5 million, or $6.56 per share, compared with $85.8 million, or $1.53 per share, in the year-ago quarter.

Super Micro is bumping up its fiscal 2024 revenue guidance to $14.7 billion to $15.1 billion from $14.3 billion to $14.7 billion. Analysts surveyed by LSEG had expected $14.60 billion. The middle of the new range implies approximately 582% year-over-year revenue growth.

“We are growing customer base strongly now,” CEO Charles Liang said on a conference call with analysts.

Notwithstanding the after-hours move, Super Micro stock is up 205% so far this year, while the S&P 500 stock index has gained 6%.

The company goes up against with legacy IT equipment providers such as Hewlett Packard Enterprise. But last year, investors were keen to bet that Super Micro could become a key provider of servers containing Nvidia graphics processing units for working with artificial intelligence models, pushing up the stock 246%.

In March, Super Micro took the place of Whirlpool in the S&P 500.

If not for a key component shortage, Super Micro would have delivered more during the quarter, Liang said on the call. He said he expects AI growth to remain strong for many quarters, if not years, to come. The fast growth required the company raise capital through a secondary offering this year, Liang said.

Super Micro’s supply chain continues to improve, said David Weigand, Super Micro’s finance chief.

The company is eager to sell liquid-cooled servers that can result in lower energy costs than air-cooled alternatives, Liang said.

WATCH: A quiet meme stock rally? Reddit, GameStop and Super Micro surge