Education Secretary Miguel Cardona, at rear, listens as Vice President Kamala Harris speaks in Washington, D.C., June 2, 2022.

Olivier Douliery | Afp | Getty Images

Amberlee McGaughey, a librarian in Pennsylvania, was not worried about the restart of student loan payments. She was done with her debt, or so she thought.

In August, she applied for the Public Service Loan Forgiveness program with her loan servicer, MOHELA, or the Missouri Higher Education Loan Authority. The PSLF program allows those who have worked for certain nonprofits or the government to get their debt erased after 120 payments, or 10 years. McGaughey’s records, reviewed by CNBC, show that she’s made 125 qualifying payments.

Still, MOHELA sent her a bill for $675, due on Oct. 7.

“I panicked,” McGaughey, 36, said. “I wasn’t expecting to go into repayment, and I definitely couldn’t afford that.”

When she contacted MOHELA, she couldn’t get anyone on the phone.

“All of my wait times were over 100 minutes,” she said. “I tried sending email messages, and they went unanswered.”

More from Personal Finance:

More colleges are offering guaranteed admission

Strategy could shave thousands off college costs

Should you apply early to college?

The Biden administration restarted student loan payments for some 40 million Americans this month, putting an end to the pandemic-era pause on the bills that had been in effect since March 2020.

So far, the transition back to payments is proving painful for many borrowers, who complain of long wait times trying to reach their servicers, errors with their bills, lost account information and denied relief for which they believed they were eligible.

These issues can have devastating impacts on household finances, consumer advocates say.

“Being forced to make incorrect monthly payments places additional strain on borrowers’ monthly finances and puts some in the position of being unable to keep up with their other bills,” said Ella Azoulay, a policy analyst at the Student Borrower Protection Center.

Outstanding education debt in the U.S. exceeds $1.7 trillion, burdening Americans more than credit card or auto debt. The average loan balance at graduation has tripled since the ’90s, to $30,000 from $10,000. Around 7% of student loan borrowers are now more than $100,000 in debt.

Changes add uncertainty for servicers, borrowers

Carolina Rodriguez, director of the Education Debt Consumer Assistance Program, a nonprofit in New York, said she’s never seen this kind of chaos in the student loan space before.

“Servicers are having a very hard time getting people back into repayment,” Rodriguez said.

In the calmest of times, the federal student loan system is famously complicated. There are some 12 plans for repaying your student loans, a web of forgiveness options, and a soup of wonky terms such as “forbearance” and “deferment.”

Recently, there have been a number of changes to the lending system, adding even more uncertainty for servicers and borrowers.

“The government has made all these announcements, and it’s really confusing to people,” said Scott Buchanan, executive director of the Student Loan Servicing Alliance, a trade group for federal student loan servicers.

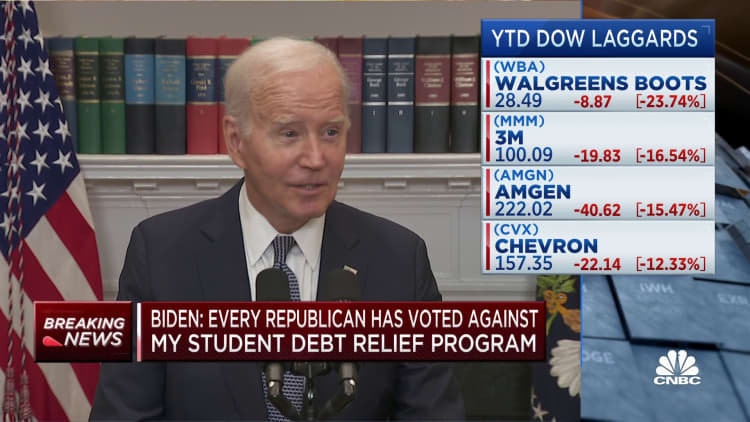

In August 2022, President Joe Biden announced that he’d forgive up to $20,000 in student debt for tens of millions of Americans. But that plan quickly faced a barrage of legal challenges, and the Supreme Court ultimately rejected it in June, ruling that the president didn’t have the authority to wipe out $400 billion in consumer debt without prior authorization from Congress.

After that setback, and with the 2024 presidential campaign looming, Biden quickly moved ahead to provide borrowers with a new set of relief options before payments restarted in October.

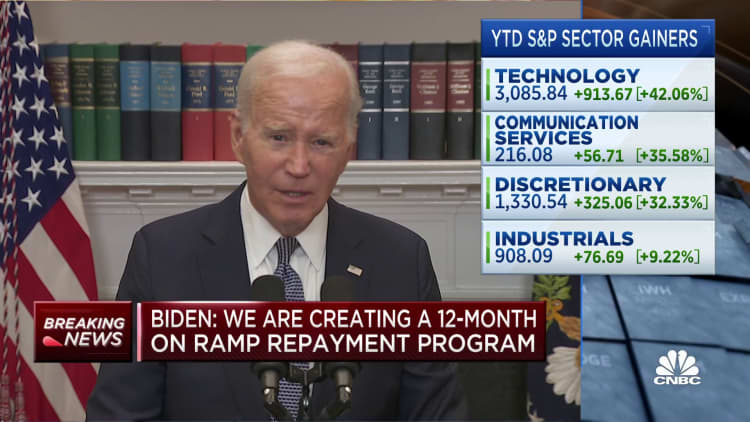

Those measures included a 12-month “on-ramp” period during which borrowers are shielded from the consequences of missed payments and a new income-based repayment plan, which the U.S. Department of Education touted as the “most affordable repayment plan ever.”

Flawed data affects SAVE applicants

Yet borrowers have had trouble benefiting from this new repayment option, called the Saving on a Valuable Education, or SAVE, plan.

Rodriguez said many borrowers are getting billed for different amounts than they expected. She said she worked with a borrower who anticipated a monthly payment of around $400 and then got a bill for $2,000.

Some of the problems with the SAVE plan, which may have affected hundreds of thousands of borrowers, are due to flawed data provided by the Education Department and loan servicers’ use of outdated figures.

But at what point do you start to question why the Biden administration is still contracting with MOHELA and servicers who have financial incentives to do the wrong thing?

Braxton Brewington

press secretary at the Debt Collective, which advocates for debt cancellation

Another issue is that some of the plan’s features — including the most beneficial one to borrowers, a drop in payments by almost half — won’t be available until next summer, due to the timeline of regulatory changes. Many borrowers didn’t realize this, experts say.

“The Department is working closely with student loan servicers to ensure that they are doing everything to provide borrowers the information they need when they need it and holding servicers accountable when they do not,” said a spokesperson for the federal agency.

For SAVE payment plan issues, the department directed servicers to notify affected borrowers and put them into an administrative forbearance until they were able to calculate the correct payment amount. It may also refund some borrowers, the spokesperson said.

‘It’s a very messy system’

Sarah Cluff

Courtesy: Sarah Cluff

Still, some borrowers are struggling to even access the new option.

In early October, Sarah Cluff tried to contact her student loan servicer, Nelnet, to apply for the SAVE plan. Under the program, borrowers’ payments are calculated based on their household size and income, and Cluff had a number of questions. She recently got married and is now pregnant.

Her original student loan bill of $483, which was listed as due on Oct. 20, wasn’t affordable for her.

“That is more expensive than our car payment,” said Cluff, 28.

She was on hold for two and a half hours with Nelnet and then was disconnected before she could speak with a representative, she said. She called back and was on hold for an hour and a half.

“The communication is very lacking,” she said. “It’s a very messy system.”

Servicers face challenges going into ‘repayment surge’

Some of the issues at servicers are due to changes in the space over the last few years.

Around 16 million borrowers were transferred to a new servicer during the pandemic, after several companies dropped out of the business. Servicing federal student loans became less profitable when borrowers weren’t making payments.

In a September letter to the student loan servicers, Sen. Elizabeth Warren, D-Mass., and other lawmakers wrote that they were “deeply worried about your preparedness for this unprecedented return to repayment.”

In response, the servicers admitted that they were concerned, too.

MOHELA wrote that when payments restart it is “anticipating extended wait times and servicing delays.”

In January, Nelnet made deep cuts to its staff. Joe Popevis, executive director of NelNet, wrote that these reductions “would significantly impact our ability to rapidly ramp back up for return to repayment.”

“Though we are attempting to rehire many of the customer service agents whose employment we previously terminated, we will not be able to hire the staff needed for the repayment surge,” Popevis wrote to the lawmakers.

Servicers have indeed been given a daunting task in restarting the payments of tens of millions of Americans, said Braxton Brewington, press secretary for the Debt Collective, an organization that advocates for debt cancellation.

Still, the long wait times and incorrect information are inexcusable, Brewington said. These companies have had months to prepare, he said. He also said that long before the pandemic, the servicers had a record of mishandling borrowers’ accounts.

All my wait times were over 100 minutes.

Amberlee McGaughey

student loan borrower

“I wish I could chalk it all up to incompetence,” Brewington said. “But at what point do you start to question why the Biden administration is still contracting with MOHELA and servicers who have financial incentives to do the wrong thing?”

Jane Fox, the Legal Aid Society chapter chair at the Association of Legal Aid Attorneys in New York, said the main issue with the federal student loan system is that servicers are paid a fee per borrower, which leaves them little incentive to resolve issues or deliver on promised debt relief.

“They are not interested in getting you forgiven sooner,” Fox said. “They want to keep you in repayment.”

Buchanan, at the Student Loan Servicing Alliance, the servicers’ trade group, blamed many of the current issues at servicers on the “funding limitations of the government.”

“We look forward to being able to add additional resources whenever the government chooses to invest more in customer service for their borrowers,” Buchanan said.

Rocky restart could leave lasting financial scars

Partly in anticipation of these issues, the Biden administration promised federal student loan borrowers that they’ll be spared most of the penalties of missed or late payments until Sept. 30, 2024, through its 12-month “on-ramp” to repayment.

Yet it is uncertain if borrowers are even able to rely on this relief.

Brewington said some customer service staff at the servicers don’t seem properly trained to present borrowers with their options.

“If they can reach the servicer to begin with, they don’t know about the on-ramp or Public Service Loan Forgiveness,” Brewington said.

Meanwhile, as McGaughey, the librarian, tries to get the student loan forgiveness to which she’s entitled, her account is showing up as past due. During her calls to MOHELA, they warn her that they’re trying to collect a debt.

This is especially worrying to her because she’s currently trying to assume the mortgage on her house after a divorce.

“My credit is good, and I don’t want a negative mark,” she said.