Salesforce ‘s (CRM) fiscal 2024 third quarter once again showed how the cloud software company has found the right balance between growing sales and improving margins. Wall Street liked what it saw. Revenue for the three months ended Oct. 31 increased 11% year-over-year to $8.72 billion, exceeding the $8.72 billion expected, according to the analysts’ consensus estimate compiled by LSEG, formerly known as Refinitiv. Non-GAAP earnings-per-share of $2.11 grew 51% from last year and beat the $2.06 predicted by analysts, LSEG data showed. GAAP stands for generally accepted accounting principles. Non-GAAP operating margin continued to expand to 31.2%, beating estimates of 30.26%, according to FactSet. On a GAAP basis, quarterly operating margin 17.2% exceeded the 15.7% expected. Operating cash flow increased 390% from the previous year to $1.53 billion, beating estimates of $313 million, FactSet data showed. Free cash flow of $1.36 billion outpaced the $681 million forecast by analysts, according to FactSet. CRM YTD mountain Salesforce YTD On top of quarterly beats nearly across the board Wednesday evening, a solid fiscal Q4 profitability guide helped send shares more than 8% higher to $249 each in after-hours trading. If those gains were to hold at Thursday’s open, the stock would easily top its new 52-week high. Bottom line It was another terrific quarter from Salesforce with steady, double-digit revenue growth and a continued operating margin uplift, leading to a huge increase in earnings per share. While some believe the margin story has largely played out already, the company is adamant that 30% is the floor and not the ceiling, suggesting more gains are ahead. Additionally, the topline growth story has some game to it, thanks to the surge in interest in its Data Cloud. An improving deal environment at some point will only make things better, and we are upbeat about the future due to the “green shoots” CEO Marc Benioff said he’s seeing. The company is expected to grow revenue around the current 10% pace for some time, accompanied by even more margin gains in the future. Therefore, it’s quite possible we see Salesforce grow its EPS at a 20% rate over the next several years. That’s what makes the stock compelling at this sub-30 price-to-earnings multiple. Quarterly commentary Salesforce beat across many key metrics despite what continues to be a measured macroeconomic environment for enterprise software companies. Salesforce continues to see strong adoption of its so-called cocktail of cloud offerings from customers who are consolidating their technology platforms to reduce complexity and drive efficiency and growth. As evidence, nine of its top 10 deals in the quarter included six or more clouds, which are reported as five units. Salesforce also saw an 80% increase in deals valued at more than $1 million, exceeding management’s expectations. Geographically, on a constant currency basis, sales increased 9% year over year in the Americas, 10% in EMEA (Europe, the Middle East, and Africa), and 21% in the Asia Pacific region (APAC). The company’s success led to an acceleration in its cRPO (current remaining performance obligation) growth to 14%, topping estimates of an 11% gain, as seen in the Companywide section of the above earnings table. At the same time, the company’s revenue attrition rate stayed low at 8%, a sign that enterprise customers can’t risk dropping Salesforce’s customer relationship management solutions. That comes even with the company’s recent 9% price increase, the first time its hiked prices in seven years. By Cloud unit, the most exciting performance in the quarter came from the Data Cloud. This a real-time customer data platform comprised of Analytics (from the Tableau acquisition) and Integration (from the Mulesoft acquisition.) Revenue growth accelerated to 22% from 16% in the prior quarter, and the company said it added 1,000 new customers in the quarter alone. Artificial intelligence is driving the interest in the Data Cloud, as more customers seek to use Mulesoft’s integration technology to unlock data across legacy systems, cloud apps, and devices. Meanwhile, Tableau is helping customers better understand data and make data-driven decisions. Salesforce is also seeing strong traction in its Einstein GPT Copilot product, which essentially is a conversational AI chatbot. The company claims 17% of the Fortune 100 are already using the tool, with many more expected to buy. On the margin side, the 850-basis-point non-GAAP improvement in the short span of 12 months showed management’s continued discipline across every part of its business, especially marketing. It’s interesting to see the company pull margin gains even with an uptick in headcount. After reducing its headcount for multiple quarters in a row as part of a profitability push, Salesforce’s headcount ended the quarter at 70,843, up from 70,456 in July. Still, this is a far cry from the 79,824 employees it had one year ago. Free cash flow continues to grow, soaring an astounding 1,088% to $1.37 billion. That gives Salesforce an easier time to make good on its commitment to repurchase stock to offset dilution from stock-based compensation. The company bought back $1.93 billion worth of shares in the quarter, consistent with the level of repurchasing activity we’ve seen in recent quarters. Salesforce’s buyback program has led to a roughly 2% decline in diluted share count from last year. The company still has about $10 billion remaining on a $20 billion share repurchase program. Guidance For its fiscal 2024 fourth quarter, Salesforce guided revenue to be in a range of $9.18 billion to $9.23 billion versus estimates of $9.22 billion, with GAAP EPS of 1.26 to $1.27 and non-GAAP EPS at $2.25 to $2.26 compared to estimates of $1.01 and $2.18, respectively. Salesforce also expects its cPRO to grow roughly 10% from last year, implying a figure of about $26.4 billion. That’s only just slightly below estimates of 10.4% growth to $27 billion. For the full fiscal year, with the current quarter remaining, Salesforce nudged up its revenue outlook to $34.75 billion to $34.8 billion, in line with the $34.78 billion consensus estimate. It increased its non-GAAP operating margin outlook to 30.5%, above the consensus estimate and previous guide of 30%. And, on the bottom line, the company expects to earn on a non-GAAP basis $8.18 to $8.19 per share, above the $8.04 consensus estimate and higher than prior guidance of $8.04 to $8.06. (Jim Cramer’s Charitable Trust is long CRM. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

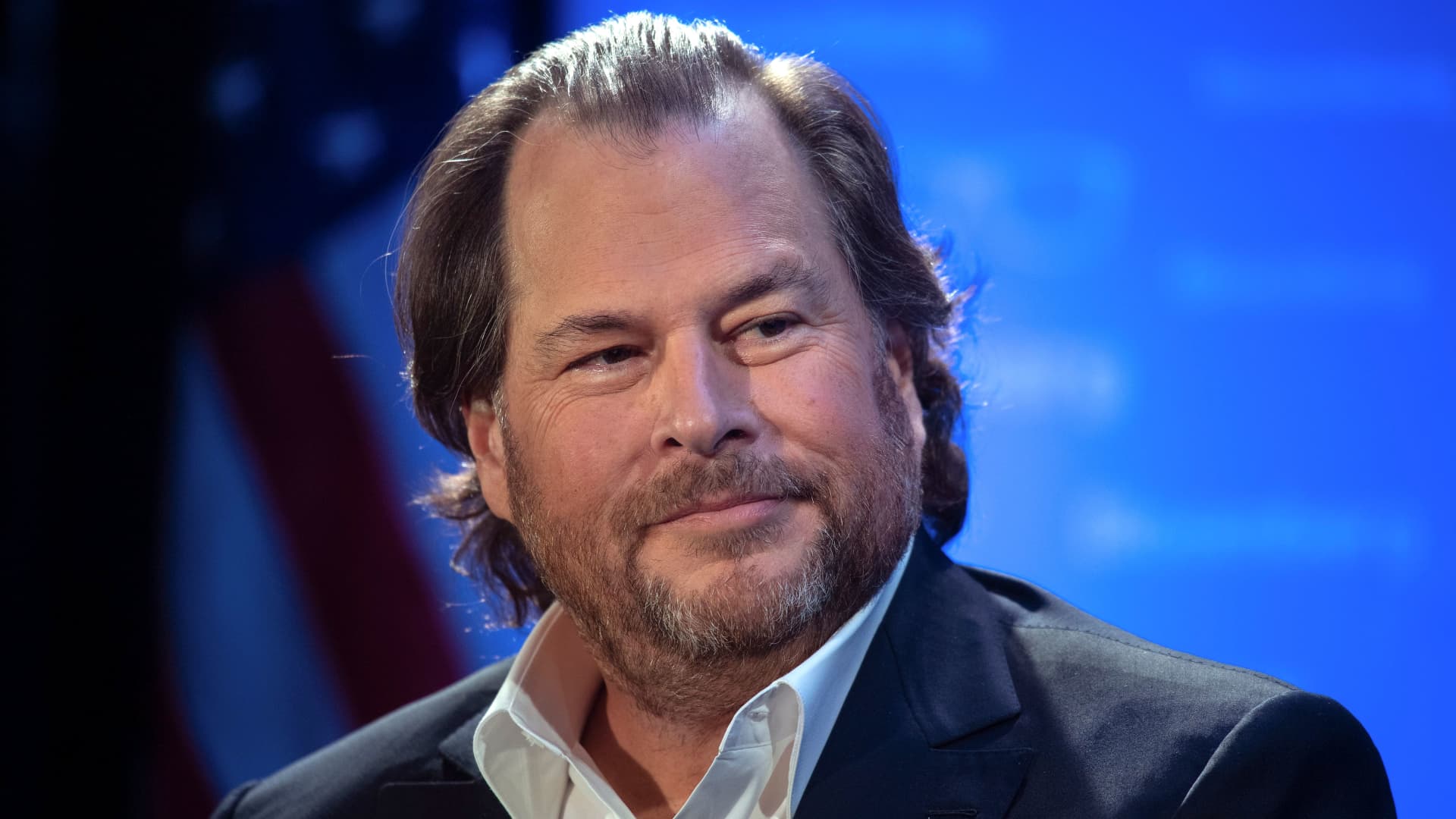

Marc Benioff, co-founder and CEO of Salesforce, speaks at an Economic Club of Washington luncheon in Washington, DC, on Oct. 18, 2019.

Nicholas Kamm | AFP | Getty Images

Salesforce‘s (CRM) fiscal 2024 third quarter once again showed how the cloud software company has found the right balance between growing sales and improving margins. Wall Street liked what it saw.

Denial of responsibility! Secular Times is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – seculartimes.com. The content will be deleted within 24 hours.