CNBC’s Jim Cramer on Friday told investors to gear up for a “fast and furious” slew of earnings reports next week that could lead to some profit-taking, including Procter & Gamble, Tesla and Lockheed Martin.

This week brought solid gains for the major indexes, with the S&P 500 closing Friday at an all-time high, and Cramer noted that the market continues to climb despite wars across the globe, budget deficits, inflation and tension in the lead-up to a fraught U.S. presidential election.

“Can the market keep this up? Only if we still have plenty of people out there bad-mouthing the market and calling it dangerous and perilous,” Cramer said. “That will ensure that we get higher stock prices, as it dawns on investors that the worries are wrong and you can get back in and get bang for your buck in the stock market.”

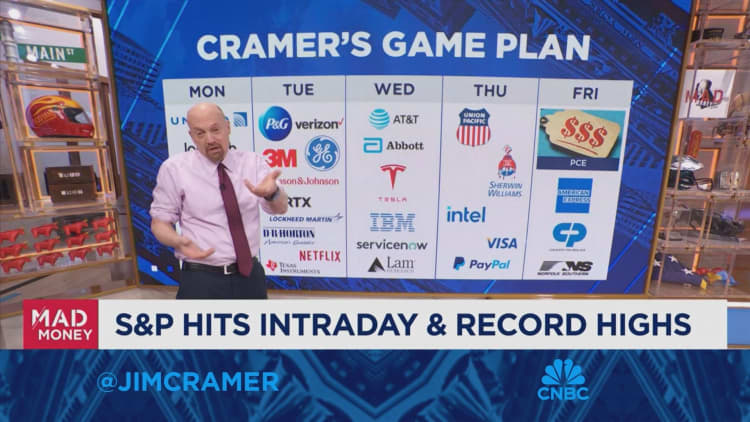

On Monday, Cramer will be paying attention to reports from United Airlines and Logitech, the latter of which could tell investors whether there is a new PC cycle.

Tuesday is one of the busiest days of the week, with reports from Procter & Gamble, Verizon, 3M, Johnson & Johnson, RTX, Lockheed Martin, D.R. Horton, General Electric and Netflix. Cramer predicted Verizon will do well, but Procter & Gamble may not see a blowout quarter, perhaps creating a buying opportunity. He’ll be waiting to hear about an increased defense budget from Lockheed Martin and said D.R. Horton can give investors insight into the spring homebuying season.

Wednesday will brings reports from AT&T, Abbott Laboratories and Tesla. Cramer said he expects AT&T to have a strong quarter, and Tesla will see a number of buyers that will stabilize its stock. Lam Research, IBM and ServiceNow will also report, and he’ll be watching to see how the latter two are integrating artificial intelligence into their business.

Union Pacific, Intel and Sherwin-Williams will report on Thursday. Cramer will also be listening to PayPal‘s analyst meeting that day, saying he thinks the new CEO might lay out a solid plan for the company. Friday will see reports from American Express, Colgate and Norfolk Southern. Cramer will also be waiting for the personal consumption expenditure number on Friday, an inflation gauge that needs to be weak for the Federal Reserve to start cutting rates.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Procter & Gamble.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com