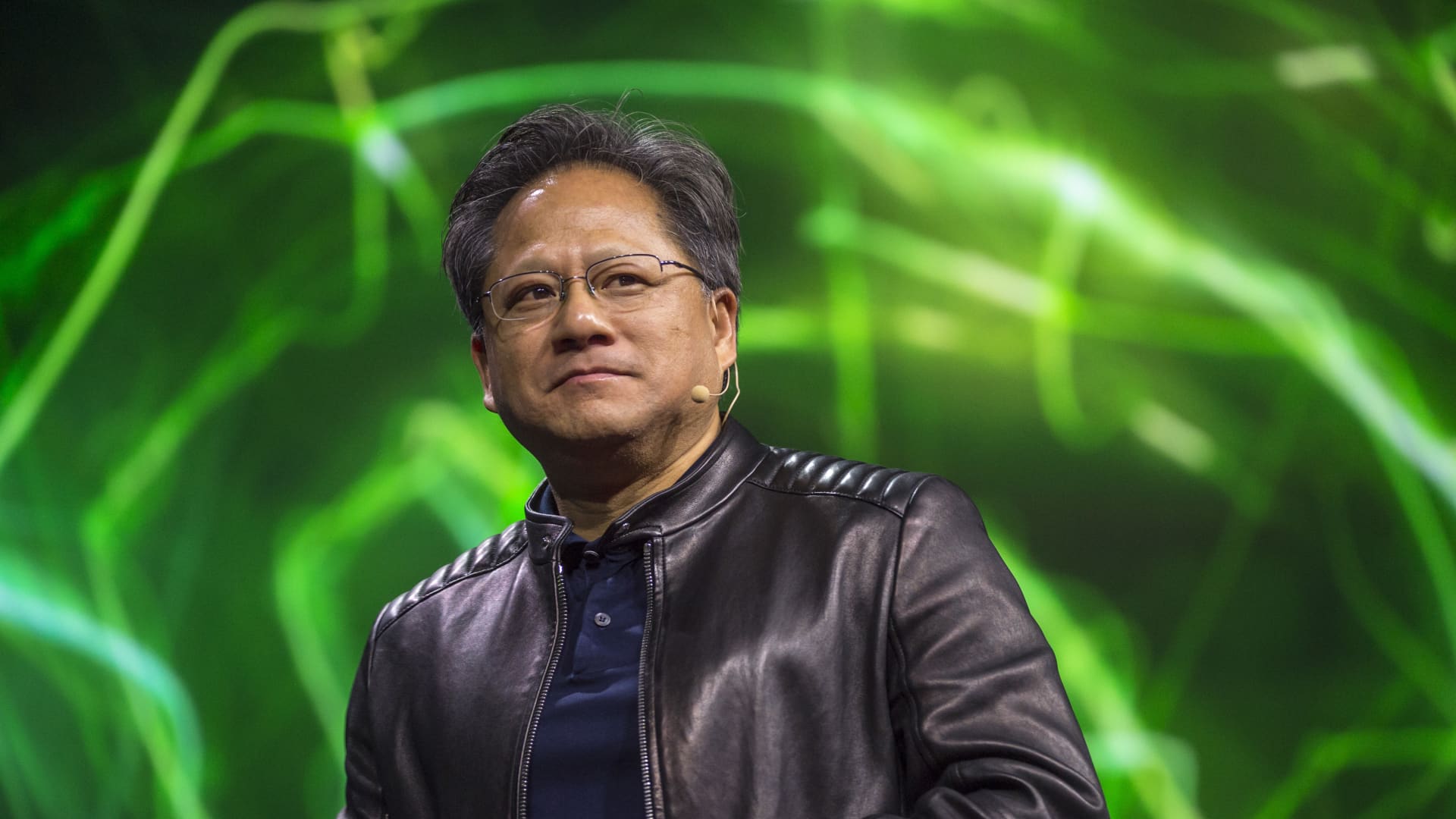

Jensen Huang, chief executive officer of Nvidia Corp.

David Paul Morris | Bloomberg | Getty Images

This report is from today’s CNBC Daily Open, our new, international markets newsletter. CNBC Daily Open brings investors up to speed on everything they need to know, no matter where they are. Like what you see? You can subscribe here.

What you need to know today

Stricter regulations for regional banks

All U.S. banks with at least $100 billion in assets — which includes regional banks — will have to issue long-term debt, according to plans by U.S. banking regulators. The debt will protect depositors in the event of a bank failure. But raising debt at potentially higher prices will squeeze margins for mid-sized banks.

Nvidia’s record close

Nvidia shares popped 4.16% Tuesday to close at a record of $487.84. Investors cheered the chipmaker’s partnership with Google, which gives users of Google Cloud greater access to technology powered by Nvidia’s H100 GPUs. Nvidia’s risen 234% this year, making it the best performer in the S&P 500.

China’s big on Costco too

Some parts of China’s economy are booming despite a general slowdown. The average daily foot traffic at Costco was around 7,000 people — two times that of the U.S. — according to David and Susan Schwartz, co-authors of the forthcoming book “The Joy of Costco: A Treasure Hunt from A to Z.” Apart from the wholesale retailer, the premium market is enjoying success as well.

Bitcoin ETF on the way?

Crypto asset manager Grayscale prevailed in its lawsuit against the Securities and Exchange Commission, which previously denied the company’s application to convert the Grayscale Bitcoin Trust to an ETF. The ruling paves the way for other companies that want to create bitcoin ETFs, like BlackRock and Fidelity. Bitcoin jumped 6% and shares of Coinbase surged 15% on the news.

[PRO] Year-end high for S&P?

The S&P 500 will be close to touching 5,000 by the end of the year, Morgan Stanley Investment Management’s Andrew Slimmon believes. Here’s why Slimmon thinks stocks will rise despite struggling in August — and the three stocks to buy to ride on the wave.

The bottom line

A sudden flurry of positive business news — and not-so-good economic data — is giving stocks a last hurrah as they try to overcome the doldrums of August.

Nvidia’s announcement of its partnership with Google gave the stock the jolt that even its out-of-this-world earnings report couldn’t. It seemed investors were waiting for signs that Nvidia’s sales could be sustained in the long-term before piling back in — and pile back in they did.

Meanwhile, cryptocurrency got a boost from the U.S. Court of Appeals for the D.C. Circuit, which ruled against the SEC’s denial of Grayscale’s bitcoin ETF. “The Commission failed to adequately explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed bitcoin ETP,” the court said, referring to exchange-traded products.

On the other side of the coin, economic data released Tuesday doesn’t look so hot. The Conference Board’s Consumer Confidence Index came in at 106.1 for August, markedly lower than the forecast of 116. “Write-in responses showed that consumers were once again preoccupied with rising prices in general, and for groceries and gasoline in particular,” said Dana Peterson, chief economist at The Conference Board.

Consumers could also be concerned about the cooling labor market. Job openings in July fell from 9.5 million a month prior to 8.8 million, the lowest level since March 2021. But that’s still around 1.5 openings per unemployed person, so the figure isn’t really cool, but a nice Goldilocks temperature.

Markets found strength on the news. The S&P 500 advanced 1.45%, its best day since June 2 and its first three-day gain for August. The Dow Jones Industrial Average climbed 0.85%. The Nasdaq Composite jumped 1.74%, thanks to a bounce in tech stocks. All three indexes closed above their 50-day moving average — the first time since Aug. 14 for the S&P.

If the personal consumptions expenditure index and the jobs report for August come in softer than expected, there’s a chance stocks can sustain this positive momentum into September.