That was more than a generation ago at the height of Japan’s post-war boom. But this time around, the economy is in recession and nobody’s talking about a bubble. Preliminary measures of exports, manufacturing, services and other indicators released Thursday suggested continued weakening.

The market sank after hitting its 1989 peak, as banks wrote off some 100 trillion yen in bad debts. Share prices remained well below the record for many years – dipping below 7,000 at one point before a series of market-boosting measures championed by the late Prime Minister Shinzo Abe in 2013 began nudging them higher.

The market has logged sharp gains in recent months, helped by strong interest from foreign investors who account for the majority of trading volume on the Tokyo exchange.

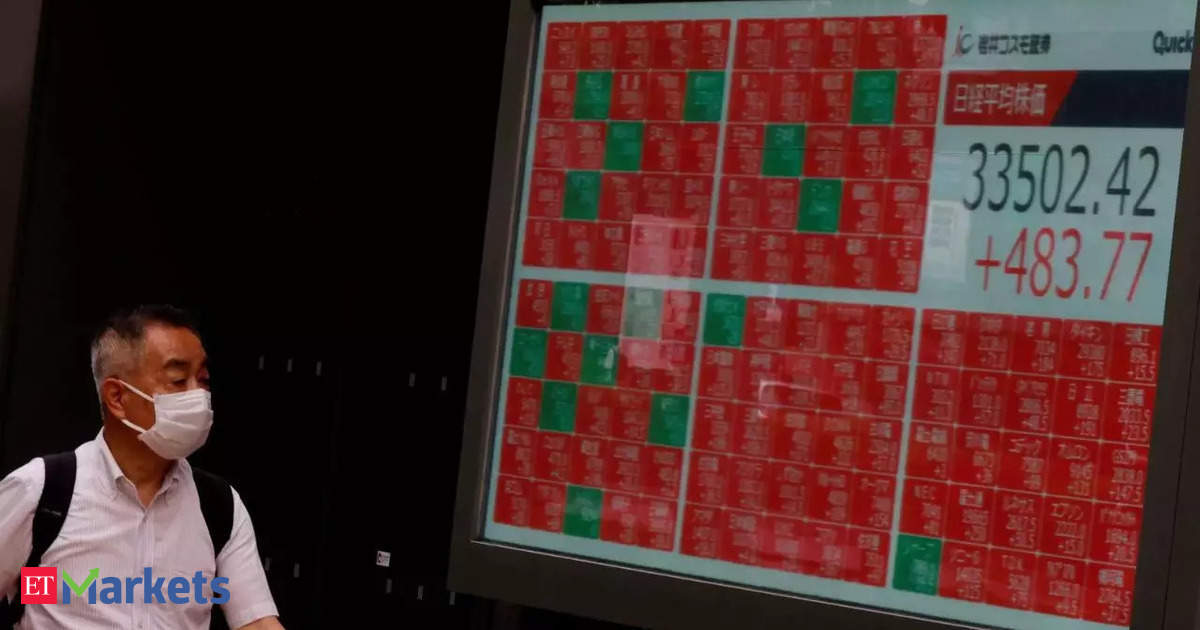

Heavy buying of computer chip-related shares helped drive Thursday’s rally after Nvidia reported after US markets closed that it had more than tripled its revenue from a year earlier thanks to the craze for artificial intelligence. Tokyo Electron’s shares jumped 6%, Advantest soared 7.5% and SoftBank Group was up 5.1%.

Agencies

AgenciesUnlike in the United States, where shares have been topping records on hopes the Federal Reserve will begin cutting high interest rates once it decides inflation is truly under control, in Japan the benchmark rate has remained at minus 0.1% for over a decade.The Bank of Japan is still using its easy money policies to spur inflation and push growth higher, and plenty of the money it has pumped into the economy has found its way into the stock market. At the same time, many global investors have been shifting their portfolios away from China as its economy slows and tensions flare between Washington and Beijing.Share prices in Tokyo have risen 15% in the past three months and about 44% in the past year. In Shanghai, prices have fallen more than 11% from a year ago, while Hong Kong’s Hang Seng index is down about 22%.

Record gains in corporate earnings for Japanese companies and improved corporate governance have enhanced the appeal of shares in Japanese companies.

Foreign investors have plunged in, seeking bargains to be had given the yen’s weakness against the U.S. dollar, which is trading at about 150 yen compared with about 140 yen a year ago.

In January, international investors bought 125.2 trillion yen of Japanese stocks, double a year earlier, according to the Tokyo Stock Exchange.

(You can now subscribe to our ETMarkets WhatsApp channel)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

Subscribe to The Economic Times Prime and read the Economic Times ePaper Online.and Sensex Today.

Top Trending Stocks: SBI Share Price, Axis Bank Share Price, HDFC Bank Share Price, Infosys Share Price, Wipro Share Price, NTPC Share Price