Malaysia has set its sights on a larger part of the electric vehicle supply chain business as competition in Southeast Asia heats up, following Tesla‘s announcement of a regional headquarters in Malaysia.

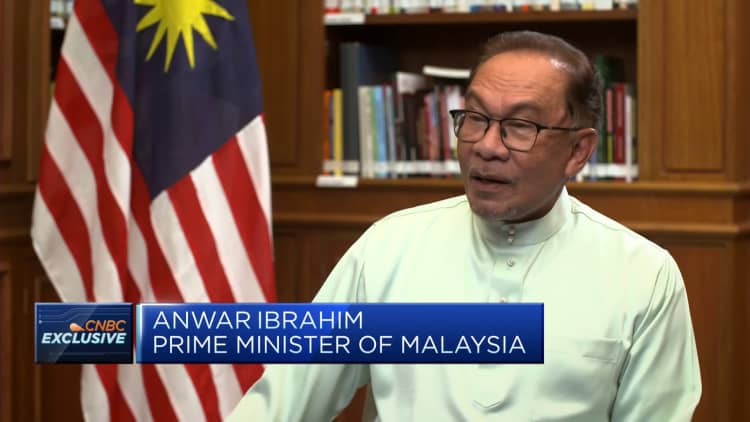

“EV happens to be our priority,” Malaysia’s Prime Minister Anwar Ibrahim told CNBC’s Martin Soong in an exclusive interview Friday at the prime minister’s offices in Putrajaya, just south of the country’s capital Kuala Lumpur.

Tesla’s groundbreaking move with Malaysia is a boost to Southeast Asia’s place in the EV supply chain and the first deal under the country’s Battery Electric Vehicle Global Leaders initiative.

The deal also represents the opportunity for the U.S. automaker to expand into a new market as growth slows in China and its other major markets.

Under the terms of Tesla’s agreement with Malaysia, the EV maker will be able to sell its Shanghai-made electric vehicles directly without any import tariffs or middleman markup.

Tesla will also establish a regional headquarters and service center in Selangor, equipped with advanced diagnostic tools and staffed with highly trained Tesla technicians.

Tesla users will eventually have access to a network of charging stations in major metropolitan areas in the country, with the first planned for downtown Kuala Lumpur.

There are also plans for Tesla to embark on EV battery manufacturing in Malaysia.

Anwar said Malaysia is open to more EV investments, including from Chinese automakers. While Chinese carmakers have “not been asking,” he said, “the possibility will be open.”

He said there will be synergy when foreign companies such as Tesla invest in Malaysia, adding that “it can benefit three or four local industries.”

Tesla exemptions

Malaysia has a long-standing Bumiputera policy favoring native populations, including the majority Malay-Muslim community and non-Malay indigenous groups.

Foreign ventures starting in Malaysia are required to meet a minimum 30% equity ownership by Bumiputeras, but Tesla is exempted from the equity rule.

“To me, [the Tesla deal] is as good as putting a 30% equity,” Anwar said in an exclusive interview that will be broadcast on The CNBC Conversation later this week.

“In fact, in terms of real advantage returns to the economy — that is better.”

After he was sworn in as Malaysia’s 10th prime minister last year, Anwar pledged to fight corruption and make “Malaysia for all Malaysians,” opening himself up to criticism he may be looking to dismantle Bumiputera privileges.

Tesla Inc. signage during a launch of company’s Model Y electric vehicle in Kuala Lumpur, Malaysia, on Thursday, July 20, 2023.

Bloomberg | Bloomberg | Getty Images

“It’s not an issue … of dismantling, it’s the issue of refocusing areas, which [are] important,” Anwar said.

“For example, the issue of affirmative action — which extends from being race-based to need-based — we cannot talk about pure meritocracy.”

Incentivizing tech transfers

Tesla’s exemption from the 30% equity requirement is not the only time that Malaysia has granted such incentives.

“This is not new. There has been exceptions … given for digital transformation, for IT-related activities or investments,” the prime minister said. “We have done that in the past — very selective. So the issue’s not just Elon Musk, which I think is much required in this country to give this confidence and the participation of our players.”

The Telsa announcement was preceded by Chinese automaker Zhejiang Geely’s $10 million plan to expand its operations in Tanjong Malim in Perak state, and German chipmaker Infineon Technologies‘ 5 billion euros ($5.46 billion) expansion of its Kulim water fabrication plant in Kedah state.

The Anwar government has been quick to tout the spike in foreign investments as a result of political stability it has brought to the table.

Malaysia recorded a lower net inflow of 3.1 billion ringgit ($666.9 million) in foreign direct investment in the quarter that ended June 30, compared to the 12 billion ringgit in the preceding quarter, according to official data.

“Incentives should be given,” Anwar said, “but what is more important to my mind, as compared to the equity, is [the] training,” Anwar said.

“It’s a transfer [of] technology — is there preparedness to continue to transfer and also to train our personnel and to the terms change in accordance to our set of priorities for the present?”

Building readiness

Still, Anwar was hesitant to say a full electric vehicle assembly line is in the pipeline.

Asked if Malaysia is aiming to be the “end game assembly” and climb up the supply chain, he said: “Well, it’s a bit too premature for me to commit,” he said. “But what is important is we do have the capacity to produce parts of battery … required in the car.”

Drawing on the example of the deepening partnership between Geely and Malaysia’s national automobile brand Proton over time, Anwar alluded to the lack of readiness currently.

But Malaysia is more than ready to manufacture EV batteries.

“Yes, the understanding is of course, buy our batteries,” Anwar said. “And it’s cheaper is produced locally. And it is the advantage.”

Meanwhile, neighboring Indonesia has been courting Tesla for years, but that has yet to yield any tangible partnerships with Elon Musk for its electric vehicle ambitions.

Indonesia is an “important neighbor to us and [we have] a lot in common,” Anwar said.

“We’re working very well together, both in government and private sector. And I think instead of being in a game of fierce competition, we should be able to complement each other,” he told CNBC.

“That has been the spirit of my government’s series of conversations with President Jokowi and followed through by the industry.”