“There are pockets of froth in the market. Some people call it a bubble, some may call it froth,” Buch told reporters in Mumbai. “It may not be appropriate to allow that froth to keep building.”

On Monday, the BSE Midcap and Smallcap indices declined 0.2% and 2%, respectively. Over the past one year, the BSE Midcap index has surged by 62%, while the BSE Smallcap index has gained 57%.

Both gauges outperformed the Sensex, which climbed 24%, with consummate ease.

“A bubble will burst because, by definition, bubbles burst. So, when they burst, they impact the investors adversely and that’s not a good thing,” she said.

Sebi and the AMFI (Association of Mutual Funds in India) have directed mutual funds to provide additional disclosures for small- and mid-cap funds from this month. “Are there others where the valuation parameters seem to be off the charts and not supported by fundamentals at all?” she asked, adding that such valuations appear to be created by what regulators would “call irrational exuberance.”

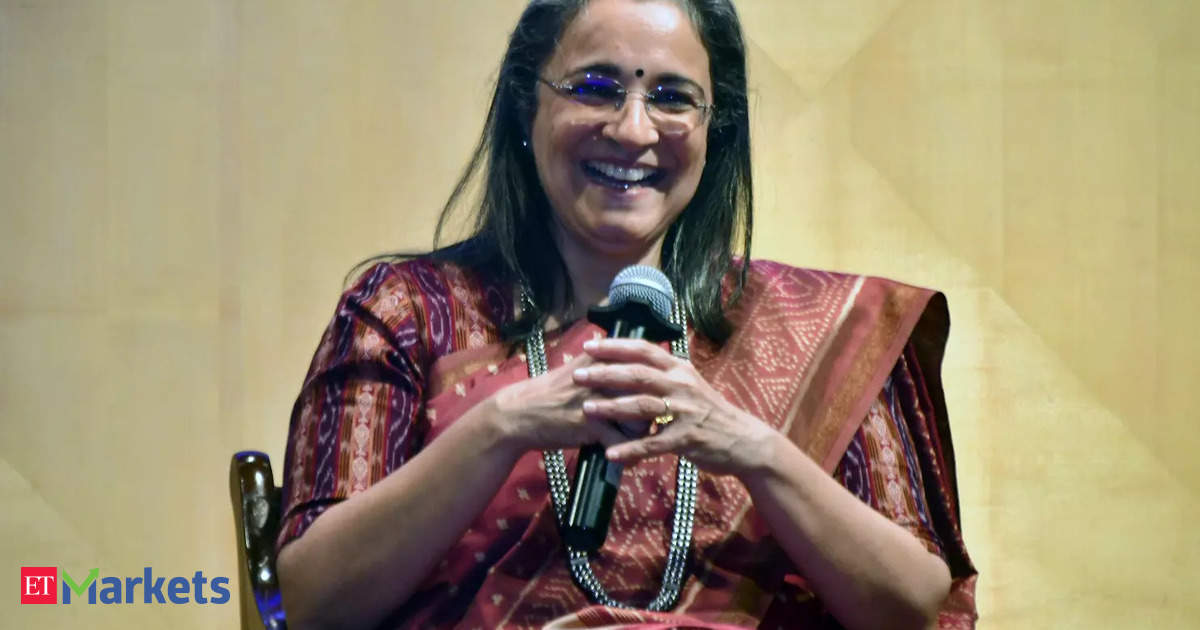

Agencies

AgenciesRecord AUMs Fuel Rally

Assets under management (AUM) of small-cap and mid-cap schemes hit Rs 2.49 lakh crore and Rs 2.94 lakh crore, respectively, in February 2024. Both are records for the two investment categories

The additional disclosure for mutual funds include valuations, volatility and stress tests.

“Investors will benefit from knowing how many days the funds would need to exit their underlying portfolio in the event of unfavourable market conditions,” she said.

The stress test results would reveal the time it may take for fund houses to liquidate securities equivalent to 50% and 25% of the portfolio assets on a pro-rata basis.

The Sebi chairperson also said the regulator has noticed signs of manipulation in the SME (Small and medium enterprises) segment.

“We do see signs of manipulation in the SME segment. The market has given its feedback. We are working on robust evidence for action,” she said. “The reality is that these are relatively small entities, the market cap is small, the free float is small. it is relatively easy to manipulate both at the IPO level and at the trading level.”

The regulator plans to bring in more disclosures on risk factors.

“For investors to understand the SME segment is different from the main board, the regulations are different, the disclosures are different, and therefore the nature of the risk is different, I think it is important for Sebi to underline that in terms of disclosures to the investors,” Buch said.

Sebi also plans allowing T+ 0 trade settlement for equities on an optional basis by March 28, Buch said.

T+ 0 would allow trades to be settled on the same day. Currently, trades are settled on a T+ 1 basis in the equities market.