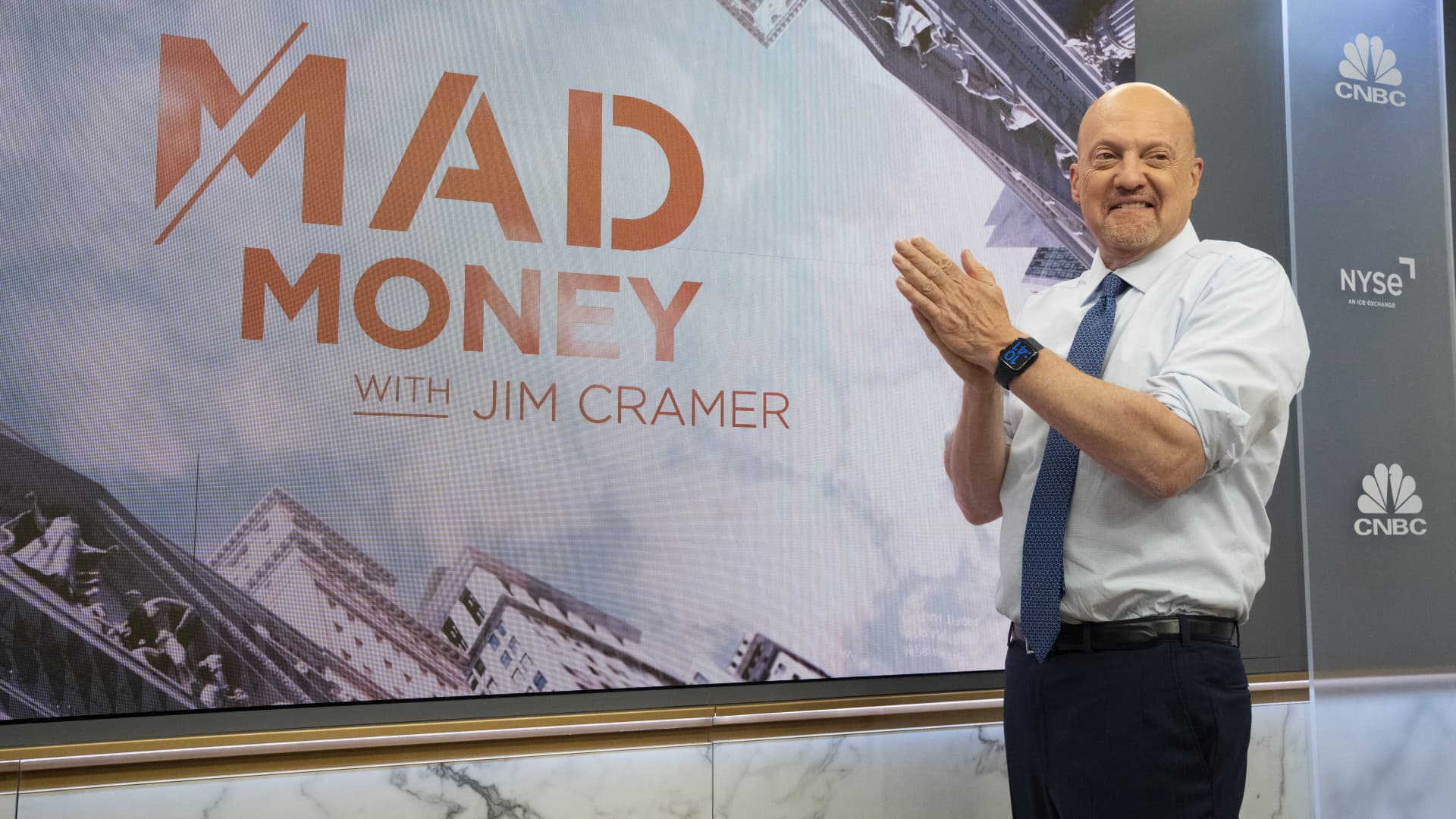

CNBC’s Jim Cramer outlined the ways that Federal Trade Commission chair Lina Khan has attempted to stop mergers and acquisitions from going through, hurting stock portfolios in the process.

“Khan’s FTC has deterred many a potential merger, and that’s kept stock valuations much lower than they should be as the Nippon Steel-U.S. Steel deal shows,” Cramer said Monday. “Yep, Khan’s been a one-woman wrecking crew for your stock portfolio even as stocks have done quite well without deals.”

One example Cramer singled out was the premium that Nippon Steel is paying for U.S. Steel, which is a deal that the two parties agreed to Monday. The buyer is offering a price of $55 per share for U.S. Steel, which closed at $39 on Friday.

That suggests that Wall Street is undervaluing the price of U.S. Steel, Cramer said, which he believes also happened because of how much focus investors have had on interest rates.

Cramer said this is one of many potential mergers and acquisitions across industries that would actually create more competition.

“What I am saying is that scale matters,” Cramer said. “If you don’t allow smaller companies to gain scale by, say, letting Walgreens buy Rite-Aid, we end up with a weak Walgreens, and a bankrupt Rite Aid, a dominant Amazon that gobbles up the whole category. Yet no one ever talks about that.”

Theoretical mergers like healthcare company Merck combining with Bristol-Meyers or food company Kraft Heinz joining with Hershey or General Mills would make their industries more competitive, Cramer said.

Khan and the FTC recently attempted to block Microsoft’s acquisition of Activision-Blizzard as well as Amgen’s acquisition of Horizon Therapeutics. The deep-pocketed legal teams of both companies allowed them to prevail through the red tape, which Cramer says has had the reverse of Khan’s intended effect.

“Lina Khan wants to stop corporate consolidation, yet she’s created a situation where only the largest, wealthiest companies can afford all the litigation that now comes with making acquisitions,” he said.

One area Cramer is not in favor of more consolidation is airlines, which he said have happened too much and have been negative for consumers.