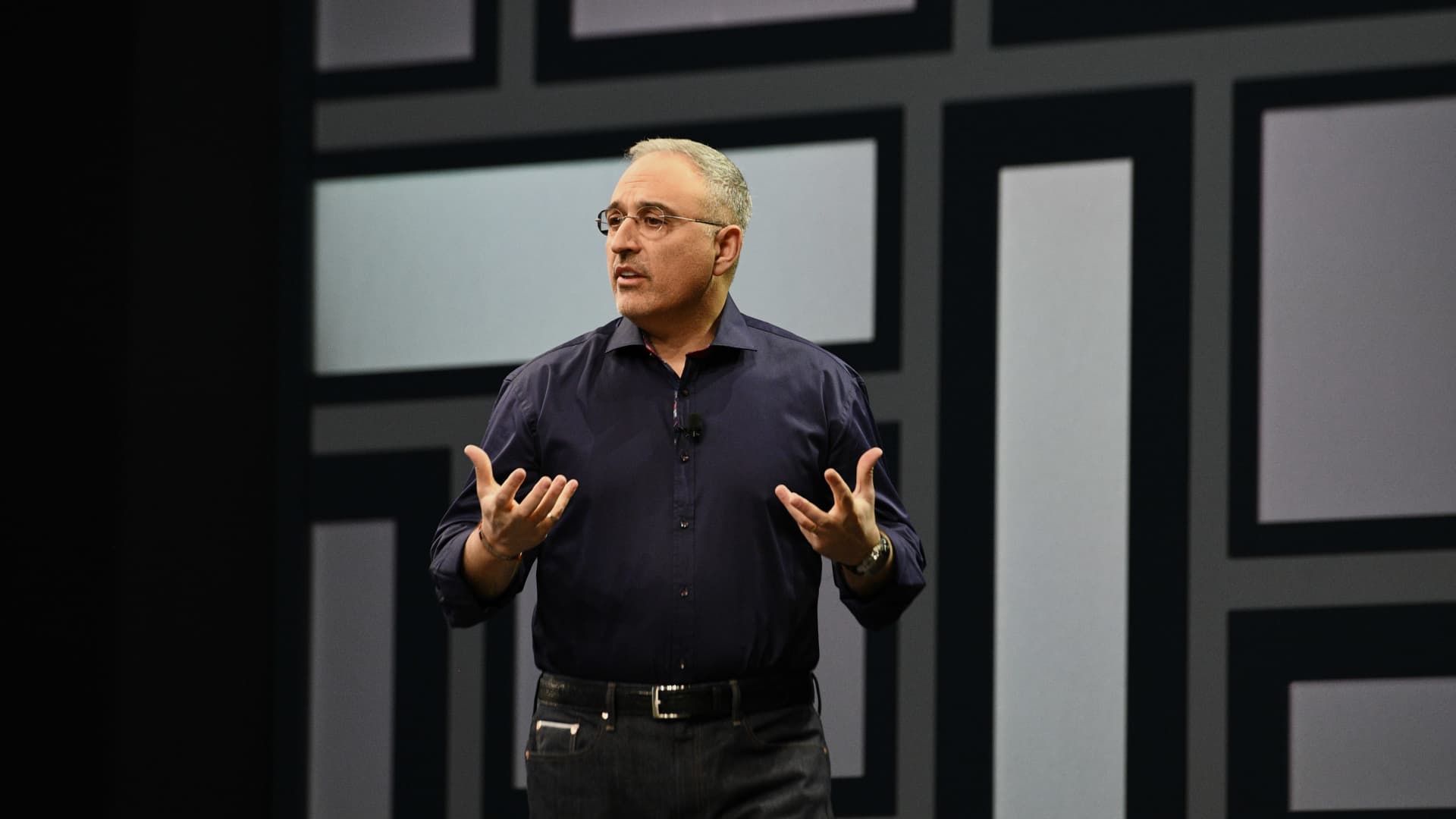

Antonio Neri, president and chief executive officer of Hewitt Packerd Enterprise (HPE), speaks during the HPE Discovery CIO Summit in Las Vegas, Nevada, U.S., on Tuesday, June 19, 2018. The summit brings together experts and industry leaders to explore the critical elements CIO’s must address to enable speed and agility, including people, use of data and approaches to security, governance and control. Photographer: Bridget Bennett/Bloomberg via Getty Images

Bloomberg | Bloomberg | Getty Images

Hewlett Packard Enterprise said in a statement on Tuesday that it plans to buy data center networking hardware maker Juniper Networks for about $14 billion, or $40 per share, in an all-cash deal. HPE said it expects to close the deal late this year or in early 2025.

The announcement came a day after the Wall Street Journal reported on HPE’s interest in buying Juniper.

Juniper shares had their best day in 20 years on Tuesday after the Wall Street Journal report, which said a deal could be announced this week. The shares jumped 22% to close at $37.05.

HPE said the deal would be accretive to its adjusted earnings per share in the first year after it closes.

The acquisition would double HPE’s existing networking business after years of competition. If it’s completed, Juniper CEO Rami Rahim would lead the combined group and report to HPE’s CEO, Antonio Neri, according to the statement.

HP got deeper into the category when it bought Aruba Networks in 2015, and months later, the technology conglomerate split in two, resulting in the formation of HPE, which sells servers and other equipment for data centers, and HP Inc., which makes PCs and printers.

HPE said adding Juniper to its portfolio would bolster margins and speed up growth.

Founded in 1996, Juniper spent many years chasing Cisco in the market for networking gear. Revenue grew 12% year over year in 2022, the fastest growth since 2010. In the most recent quarter, Juniper eked out a $76 million profit on $1.4 billion in revenue, which declined 1%.

HPE’s networking segment was the company’s top source of earnings before taxes, at $401 million on $1.4 billion in revenue, which was up 41%.

Coming together would lead to $450 million in annual cost savings within three years of the deal’s completion, HPE said.

The two companies will talk about their deal during a conference call starting at 8:30 a.m. ET on Wednesday, Jan. 10.

JPMorgan and Qatalyst advised HPE, according to the statement.

— CNBC’s Ari Levy contributed to this report.

This is breaking news. Please check back for updates.