After leaving engineering jobs at Amazon three years ago, Brett Skaloud and Jeff Feiereisen built a showerhead startup with social media virality, thousands of customers and $5 million in projected annual revenue.

They still couldn’t land a deal on Friday’s episode of ABC’s “Shark Tank” due to making what billionaire investor Mark Cuban referred to as “the biggest mistake startups make”: trying to grow their brand too quickly.

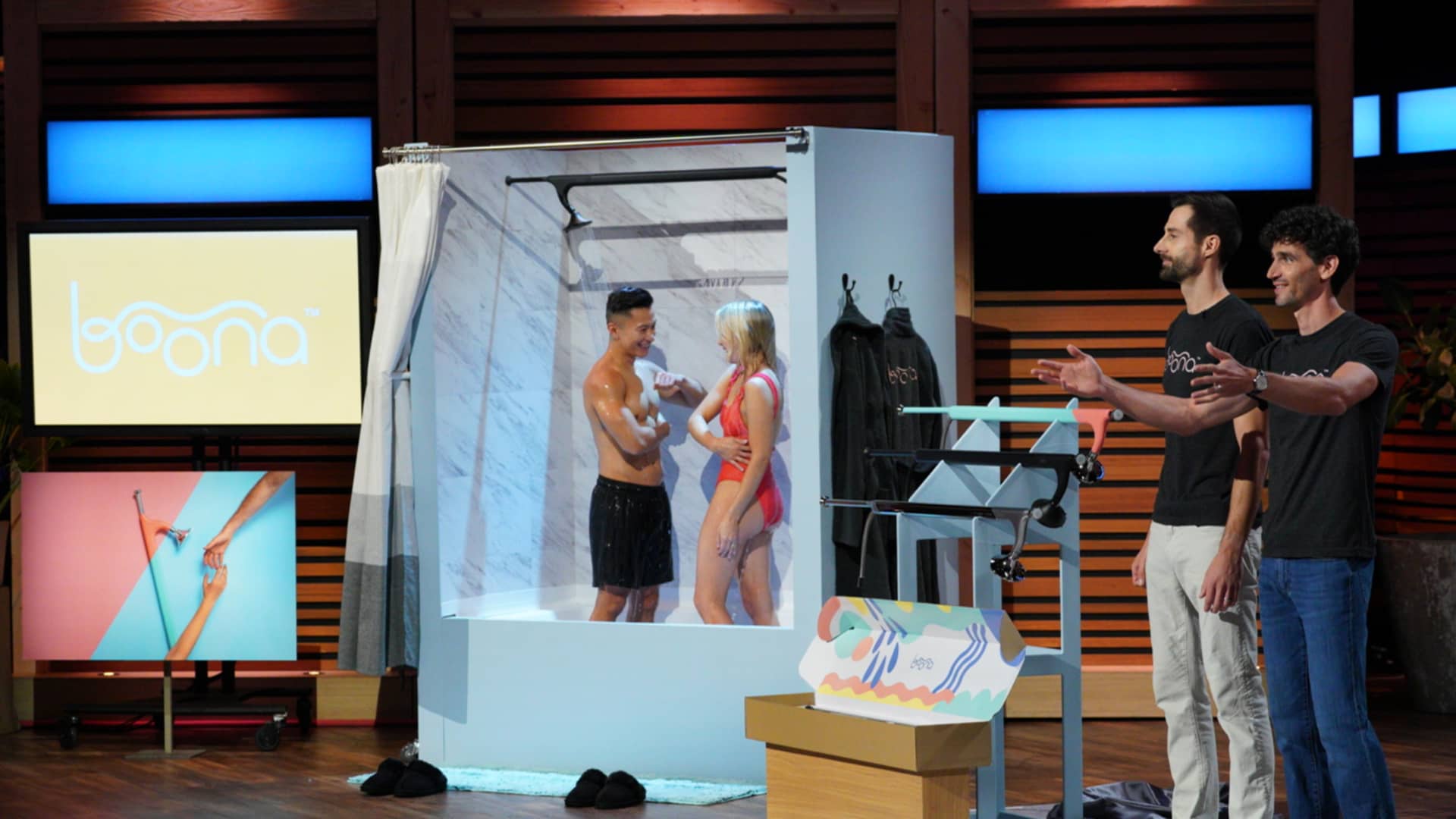

Skaloud and Feiereisen co-founded Boona, a Seattle-based company that makes a $249 showerhead called the “Tandem.” It attaches to most standard extant showers, turning them into couples’ showers by adding a new stream of water on the opposite wall.

On the show, they asked for $400,000 in exchange for 10% of their startup — saying they wanted to expand Boona past the Tandem, into additional product lines and revenue streams.

“We want to build a brand,” Feiereisen said. “We have a lot of [intellectual property] around this product, but we’re not banking the business on it. I mean, the next obvious opportunity for us is just the handhelds.”

The statement raised a red flag for at least a couple of the show’s investor judges.

“I don’t buy it as a company yet, I see it as a very interesting innovation as a product,” said Kevin O’Leary. “Some of the greatest deals in ‘Shark Tank’ history [are] when the entrepreneur focused on that one application and maxed it out.”

“That’s our focus right now,” Skaloud responded.

“Well, I’m not sure. You were telling me about building a business, other SKUs, a brand strategy, which scares me,” O’Leary said.

Cuban backed up O’Leary, adding that when startups make this mistake, “they want to be a brand, as opposed to just executing on selling their product. [But] what builds a brand is your execution.”

“That’s why for us, the absolute focus is definitely on Tandem. And if we do create new products, it’s to support Tandem,” Feiereisen said, trying to reel investors back in.

‘You came to the advice tank’

At the time of filming, Skaloud and Feiereisen projected $1.7 million in annual revenue by the end of that year, and $5 million the following year. Boona had 5,000 customers, a mailing list of 40,000 people and a Kickstarter campaign that garnered $774,000, the duo added.

Three of the investors — Barbara Corcoran, Robert Herjavec and Lori Greiner — dropped out quickly.

“I can’t relate to the product at all for two reasons. I’m a bather and I love high [water pressure], and I’m concerned about you cutting the pressure in half,” said Corcoran. “Secondly, I just couldn’t imagine getting into a shower with my husband Bill.”

This left Cuban and O’Leary.

“Guys, I think [the Tandem] is just going to be a cash-generating machine, and the biggest mistake you could make would be to try to grow too fast,” Cuban reiterated. “Just take the money [customers] are throwing at you. But that’s not conducive to an investor because if it’s $400,000 for 10%, you have to generate $4 million in after-tax profits just for me to get my money back … I’m out.”

O’Leary offered the duo $400,000 with a $40 royalty per unit until he got $1.2 million back, plus a 10% equity stake — or $400,000 to become their third partner with a 33.3% equity stake. He retracted both offers after Skaloud and Feiereisen spent too much time answering questions posed by Cuban.

“You’ve got to make a decision,” he said. “You can’t do it, that tells me you’re not sharp enough … You came to the advice tank.”

The pair left the show empty-handed, but appreciative of the feedback they received.

“We would have loved to have gotten a deal, but I think their logic makes sense and I’m excited to continue building this business exactly as per their advice,” Feiereisen said.

Disclosure: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

Want to make extra money outside of your day job? Sign up for CNBC’s new online course How to Earn Passive Income Online to learn about common passive income streams, tips to get started and real-life success stories. Register today and save 50% with discount code EARLYBIRD.