The first of two major antitrust lawsuits brought by the Justice Department against Alphabet -owned Google is set to go to trial in Washington, D.C., this week. It represents the biggest tech monopoly action to see the inside of a courtroom in more than two decades. The Club is worried about one of the cases more than the other. Tuesday’s highly anticipated trial, nearly three years in the making, stems from DOJ allegations that Google unfairly used exclusive deals with mobile companies and browser firms to make its search engine the default for consumers. Google denies those claims, arguing its practices are not anticompetitive and foster a better user experience. The suit was filed in October 2020 in the U.S. District Court for the District of Columbia. The second government complaint , which was filed in January in the U.S. District Court for the Eastern District of Virginia, alleges that Google engaged in monopolistic behavior in its advertising technology business. Google has denied any wrongdoing. This ad-tech litigation has us more concerned because it goes to the heart of Google’s main revenue stream. European Union regulators are pushing for a breakup of Google’s online ad business. Search antitrust suit Alphabet’s arrangements with companies such as Apple (AAPL) and Mozilla, which makes the Firefox browser, as well as Samsung and Verizon (VZ) make Google the default search engine on their services. In particular, the DOJ will be targeting Google’s deal with Apple, which is expected to be worth between $8 billion to $12 billion a year. Apple executives are expected to be called at the Google trial. JPMorgan views the trial that starts Tuesday as a “win-win” for Google. In a research note Friday, the analysts said a ruling in Google’s favor keeps the status quo while a ruling against the company means it would save billions in traffic acquisition cost (TAC) payments to affiliates and firms like Apple and likely won’t lead to a big loss in search market share. To be sure, if Google loses, the analysts from JPMorgan see the risk of other competitors, like distant No. 2 search engine Bing from Microsoft (MSFT), making some market share inroads, or Apple developing its own search engine. Google has previously responded to the DOJ search antitrust suit. “People use Google Search because they choose to, not because they are forced to or because they cannot easily find alternative ways to search for information on the internet,” the company said in published remarks in December 2020. Ad tech antitrust suit The Justice Department’s separate lawsuit targeting Google’s advertising business claims that Alphabet is manipulating the price of ads on Google by being both the buyer and seller in the ad exchange market. In a January blog post, Google responded to the DOJ by saying it is “one of hundreds of companies that enable the placement of ads across the internet. And it’s well reported that competition is increasing as more and more companies enter and invest in building their investing businesses.” In this case, a Google win would be a tailwind for the company, but a DOJ win could impact the future Alphabet earnings. Jim Cramer is more focused on this case since a defeat would probably force Google to divest some of its key ad tech assets. “The government has a very compelling case if you believe that the universe of ads sales is limited to what Google dominates, which is the auction,” Jim explained Friday during the Club’s Morning Meeting . Google runs an instant auction to advertisers that determines which ads appear and in what order. Jim added, however, that the government may have a harder time proving its case given the presence of alternative advertising platforms such as Meta Platforms (META) and Amazon (AMZN). Bottom line The “win-win” thesis presented by JPMorgan is intriguing — and to us, it makes some sense, which is why we think Tuesday’s trial isn’t the one investors should be focused on. If the trial goes in Google’s favor, then it’s business as usual for the company and nothing changes. If it were to lose, it’s unlikely that Google would lose a significant amount of market share in search given that it is so engrained in everyone’s online habits. It’s like what the company just went through with chatbots. A few months ago, there was a belief that Microsoft’s ChatGPT-infused Bing would usurp Google’s search dominance. But those predictions have been proven wrong. However, that doesn’t mean Alphabet is completely absolved from regulatory risk. We still see the advertising technology lawsuit as a potential issue, though admittedly we are less concerned about it than before because Alphabet can make the argument that the advertising universe is less concentrated than it was before. With Alphabet’s fundamentals strong thanks to the recent pickup in search revenue, the Google Cloud business is poised to benefit from recent AI enhancements, and the stock still trading at a very reasonable valuation. We think it’s worth sticking with for the long term. — Jeff Marks , the director of portfolio analysis for the CNBC Investing Club, contributed to this report. (Jim Cramer’s Charitable Trust is long GOOGL, AAPL, MSFT, META, AMZN. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

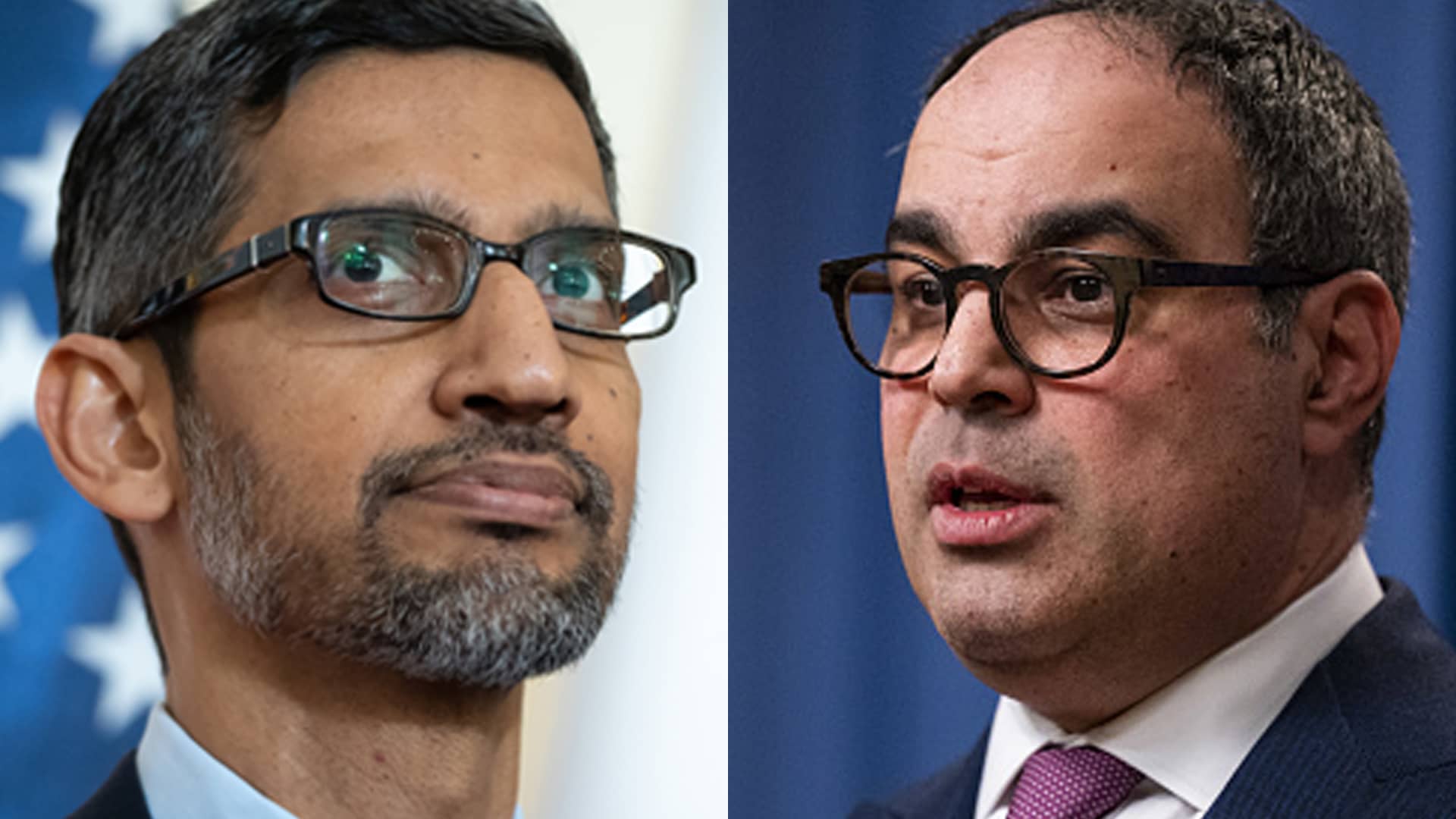

Google CEO, Sundar Pichai (: and Jonathan Kanter, assistant attorney general of antitrust for the US Department of Justice (R).

Getty Images

The first of two major antitrust lawsuits brought by the Justice Department against Alphabet-owned Google is set to go to trial in Washington, D.C., this week. It represents the biggest tech monopoly action to see the inside of a courtroom in more than two decades. The Club is worried about one of the cases more than the other.

Denial of responsibility! Secular Times is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – seculartimes.com. The content will be deleted within 24 hours.