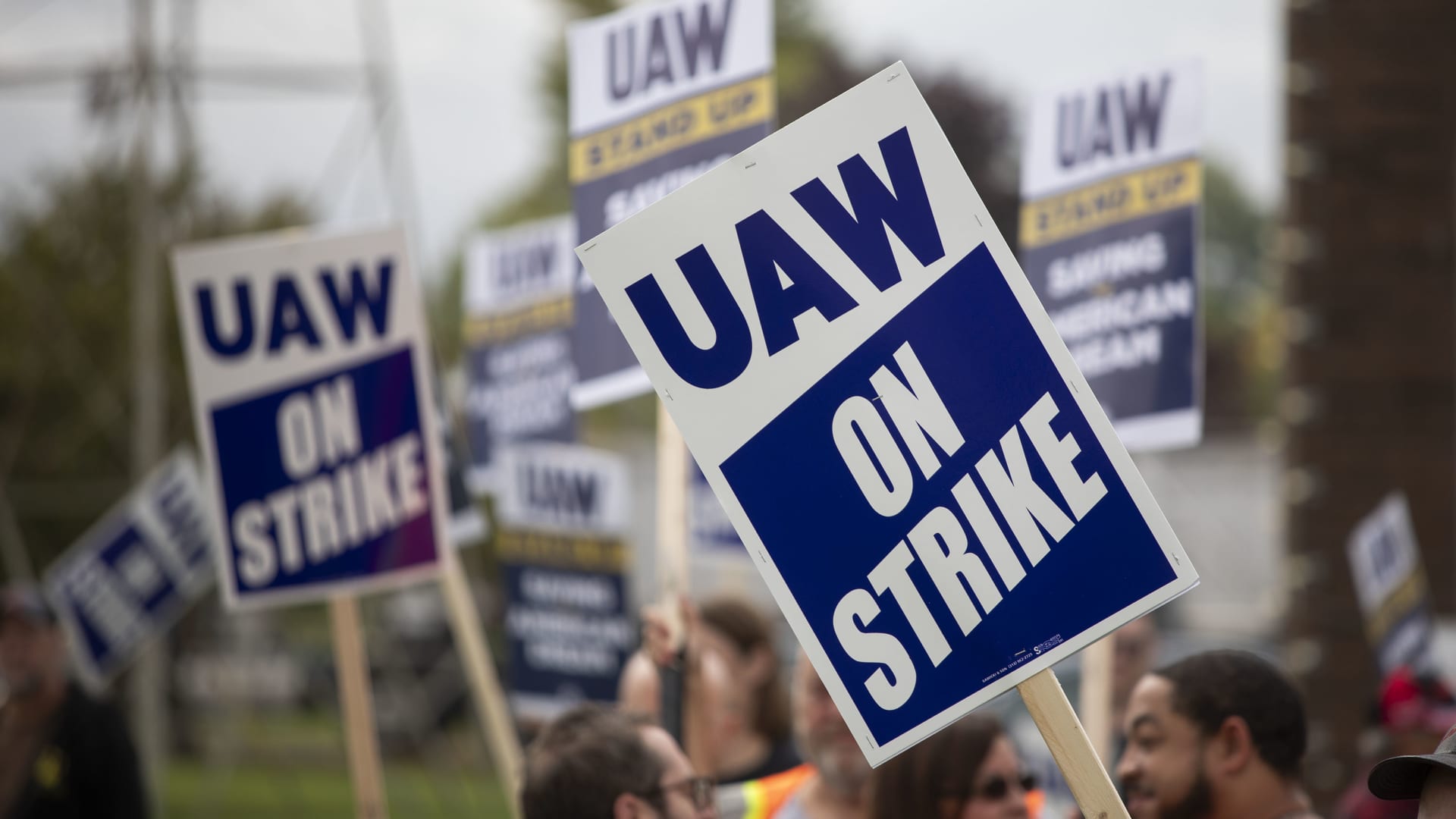

United Auto Workers members strike the General Motors Lansing Delta Assembly Plant on September 29, 2023 in Lansing, Michigan.

Bill Pugliano | Getty Images

DETROIT – General Motors’ stock price fell below $30 a share Thursday for the first time in more than three years amid ongoing strikes by the United Auto Workers union and a report of a potentially costly airbag recall for the automaker.

Since the UAW union’s targeted strikes began Sept. 15, shares of the Detroit automaker have fallen by more than 10%. The stock closed at $33.66 a share a day before the work stoppages began.

The most recent share decline occurred midday Thursday following The Wall Street Journal reporting GM has at least 20 million vehicles built with a potentially dangerous air-bag part that the government says should be recalled before more people are hurt or killed.

The potential recall of roughly 52 million air-bag inflators had been reported about previously, but the number of affected GM vehicles had not.

The National Highway Traffic Safety Administration is holding a public meeting Thursday on its determination that the air-bag parts are defective and should be recalled, according to the report.

GM’s stock since Oct. 1, 2020

GM did not immediately respond for comment regarding the WSJ article.

While many Wall Street analysts have said a strike by the UAW was already priced into GM shares, the automaker’s stock has only experienced five positive trading days out of 14 sessions.

GM confirmed Thursday it had made a counteroffer to the union, marking its sixth since the start of negotiations. It comes a day after the automaker said the strike cost it $200 million in lost production during the third quarter.

“We believe we have a compelling offer that would reward our team members and allow GM to succeed and thrive into the future. We continue to stand ready and willing to negotiate in good faith 24/7 to reach an agreement,” the company said Thursday in an emailed statement.

The last time shares of GM dropped below $30 a share during intraday trading was on Oct. 2, 2020, according to FactSet.