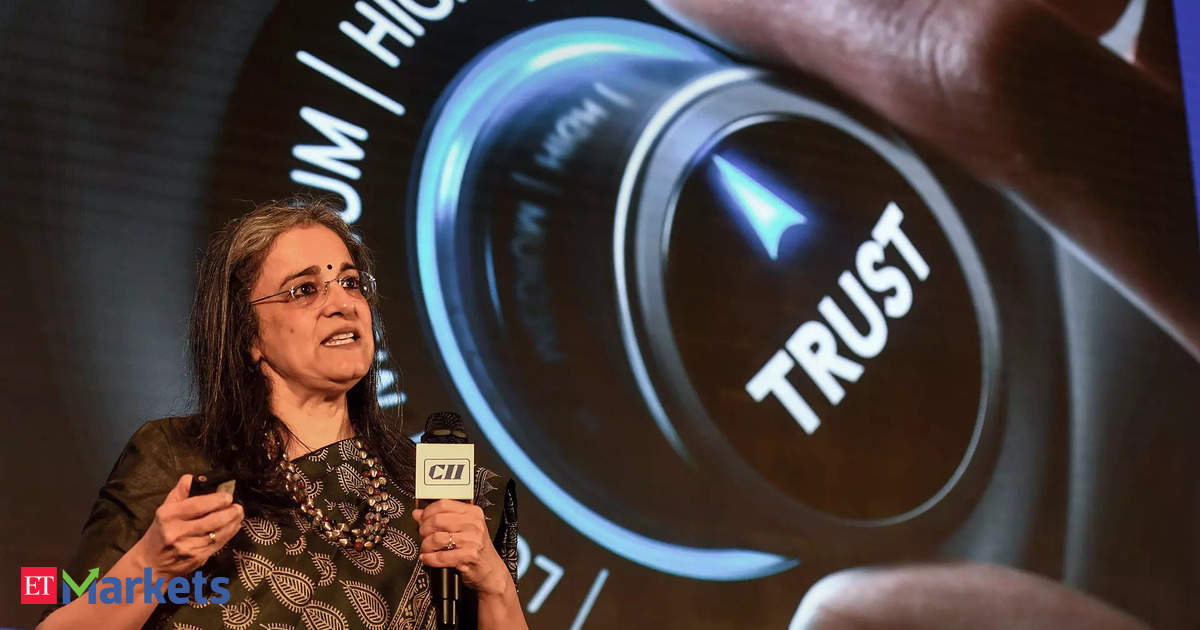

“Why is it that our markets are commanding this price to earnings multiple which is higher than not only the average of the world indices but also when compared with various nations?” Buch at a CII event on corporate governance.

“At 22.2x, yes, some people say that we are an expensive market but, still, why is the investment coming? Because this is a reflection of the optimism and the trust and faith the world has in India today that we are commanding this kind of multiples in our markets,” she added.

In the past one year, the Indian equity indices have gained over 25% ( Nifty 29.07% Sensex 25.04%) as compared to the 16.88% and 11.15% upmove in the NYSE Composite and pan-Euro Stoxx 600 indices, respectively.

Elsewhere in Asia, China declined 6.72% while Japan’s Nikkei 225 index advanced 41.33% in the last one year.

Last month, Buch had raised concerns over stretched valuations of small and mid- cap stocks, saying there are pockets of froth in the market. The regulatory body head also pointed out that with the introduction of shorter trade settlement cycles the functioning of the stock markets have improved significantly. “We measure defect rate of settlement with the DVP ratio or the delivery versus payment ratio,” she said.

“Prior to T+1 (settlement cycle) DVP ratio was 0.7-0-8 percent. After T+1, the ratio has halved to 0.3-0.4 percent. So the entire process (of a securities market transaction) has become far more optimal and efficient after T+1,” she added.

In 2021, India introduced T+1 trade settlement cycle for equities in a phased manner. A few days ago, same day trade settlement was introduced on an optional basis in the equity cash market for a limited set of 25 stocks.