A customer exits a Piraeus Bank SA bank branch in Thessaloniki, Greece.

Bloomberg | Bloomberg | Getty Images

“They just want profits, they don’t think about people.”

Those words from Marco Oliveira, a 50-year-old graphic designer from Portugal, underscore a deep lying annoyance in Europe with people bemoaning a lack of return on their savings despite surging interest rates.

“We are not getting good rates,” a 56-year-old Spaniard, Carlos Stilianopoulos, confirmed to CNBC.

European savers complain their banks have been quick to raise mortgage payments as the European Central Bank has pushed up its benchmark rate, but have been very slow at increasing rates for savings accounts.

In order to bring down inflation, the ECB has raised rates several times since July 2022. This, in practice, should translate into higher rates both on mortgages, but also on deposits. However, data shows this is not quite the case.

The key metric used by analysts is the deposit delta — which represents the increase in policy rates that banks pass through to the interest rates on deposits. The higher the figure is, the more banks are passing on.

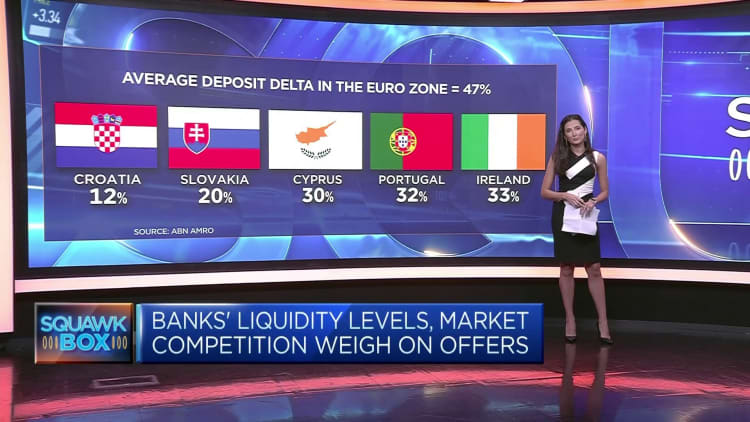

According to Dutch lender ABN Amro, the average deposit delta in the euro zone in June this year was 47% — this means that on average only half of the total 4.25 percentage point increase in ECB interest rates has been passed on to depositors. The ECB raised its benchmark rate in July 2022, from -0.5% to 0%. The rate is now at at 3.75%, meaning that since that first rate hike the ECB’s main rate has risen by 4.25 percentage points.

However, the average deposit delta across the 20 countries that share the euro masks stark differences among those nations. For instance, Croatia’s deposit delta is 12%, Cyprus is 30% and Portugal stands at 32%. In France, the deposit delta is 73% and in Italy it is 62%.

Regional discrepancies

Even though euro zone nations share the same currency and they are under the same monetary policy decisions, savers across the region are not enjoying the same returns on their deposits.

“There are indeed some stark differences among European countries,” Marta Ferro Teixeira, analyst at ABN AMRO, told CNBC via email.

“This is the result of differences in the structure of the banking industry, nature of deposits, and alternative investment opportunities,” Teixeira said.

S&P Global compared how much euro zone banks were now passing on to that seen in 2005, when the ECB last entered a rate-hiking cycle. It concluded that banks are now much slower completing this task.

Nicolas Charnay, a primary credit analyst at S&P Global, cited a few reasons behind the discrepancy. Speaking to CNBC, he said differences in banks’ liquidity levels and the various degrees of market competition impact what’s on offer for savers.

Given the low rates offered on deposits, some retail investors have been searching for more attractive investments elsewhere. For instance, in Portugal, government debt certificates were offering 3.5% earlier this year and savers were pouring into this asset class. That’s until the government decided in June to cap returns at 2.5%.

“Some say that the change was the result of pressure from the banking sector on the government. And indeed, Portuguese banks show one of the lowest deposit delta, being the fifth worst in Europe,” Teixeira said.

Filipe Garcia, a Portuguese economist, told CNBC that lenders in his country do not feel they need to attract more savings from customers, and without competition inside the sector, the rates offered to savers will not go up significantly.

Reputational damage

Disgruntled savers could still raise problems for the banking sector.

“Banks should pay more for deposits with the aim to manage the relationship of trust they have with clients,” Garcia said, adding that customers feel defrauded given they are paying more for their mortgages, but not feeling the benefit on their savings.

“The public has not forgotten the government support to the banks during the [sovereign] debt crisis,” Garcia said.

Portugal, like a handful of other European nations, had to undergo deep changes to its banking system in the wake of the global financial crisis of 2008 and the subsequent euro zone sovereign debt crisis. Feelings toward the banking system then became even more agitated with lenders notching healthy profits.

A customer uses an automated teller machine outside a Caixabank SA branch in Barcelona, Spain.

Bloomberg | Bloomberg | Getty Images

Data collected by S&P Global shows that, during the last reporting season for 25 banks in Europe, 19 reported quarter-on-quarter increases in net interest income. A higher net interest income means banks are getting more money from lending than what they are paying on deposits.

Higher profits are spurring a debate about windfall taxes. Italy has become the latest nation to announce a 40% levy on banks’ profits and, though the measure is still undergoing adjustments, it shows how some lawmakers want to tap banks’ returns.

Spain approved a windfall tax on banks last year and it could raise as much as 3 billion euros ($3.3 billion) from it by 2024, according to Reuters.

“It is a PNL [profit and loss] issue,” Stilianopoulos from Spain said, adding that banks are enjoying a “free ride” by charging more from mortgage holders and not passing higher returns to savers.

He said, however, that governments and regulators are not stepping in — for now — because they are more worried about banks than savers.

“When banks are making money, they [government and regulators] do not need to save them,” he said, referring to the sovereign debt crisis.

Where are the regulators?

Indeed, there are questions regarding the regulators and why they are not taking more action.

In the U.K., the Financial Conduct Authority announced an action plan in late July to ensure lenders were passing on interest rate rises to savers “appropriately.”

“We want a competitive cash savings market that delivers better deals for savers, where interest rates are reviewed quickly following base rate changes and firms prompt savers to switch to accounts paying higher rates,” Sheldon Mills, executive director of consumers and competition at the FCA, said in a statement.

At the time, FCA data showed that nine of the biggest savings providers, on average, only passed through 28% of the base rate rise to their easy access deposits between January 2022 to May 2023. However, for savings on a notice or fixed term, the same nine financial providers were passing through 51% of the base rate increase.

For its part, ECB officials have also reiterated that banks need to pass on these higher rates to savings, but there’s been no full investigation or action from regulators so far.

“Remuneration of deposits should go in parallel with rate rises on the assets side of the banks. Rates should go up not only for credits but also for deposits. This is something we are looking at very carefully,” ECB Vice President Luis de Guindos said in February.