An oil pump at sunset in Daqing, Heilongjiang province, China, on July 13, 2006.

Lucas Schifres | Getty Images

China’s demand for many major commodities has been growing at “robust rates,” Goldman Sachs said in a recent note.

The investment bank observed that China’s demand for copper has risen 8% year on year, while appetite for iron ore and oil are up by 7% and 6%, respectively, all beating Goldman’s full-year expectations.

“This strength in demand has largely been tied to a combination of strong growth from the green economy, grid and property completions,” the Goldman report observed.

While China’s embattled property sector is still struggling to recover, the investment bank noted that China’s green economy has shown “significant strength” so far this year, resulting in a demand surge for metals related to the green transition, such as copper.

Goldman’s economists attributed China’s green copper rush largely to its onshore solar installations, which in 2023 so far have “amounted to the level of all previous years’ installations.”

Molten copper flowing into molds at a smelting plant in Wuzhou, China.

He Huawen | Visual China Group | Getty Images

China’s operating solar capacity has reached 228 GW, more than the rest of the world combined, a June report by the Global Energy Monitor said. And the world’s second-largest economy is on track to double its wind and solar capacity five years ahead of its 2030 goals.

According to data collated by Goldman Sachs, China’s green copper demand rose 71% in July from a year ago.

“The most significant strength has come on the renewables side where related copper demand is up 130% y/y year-to-date, led by surging solar related demand,” Goldman wrote in a separate report dated Aug. 25.

Recovery in China’s manufacturing sector is also boosting demand for base metals like aluminum.

“The improvement in manufacturing trends so far in Q3 has also coincided with stronger import levels of base metals,” the report stated.

China’s industrial production grew by 4.5% in August compared to a year ago, beating expectations for 3.9% growth. And within that category, the value added of equipment manufacturing grew 5.4% year on year.

Goldman predicted demand growth for these metals is set to continue.

“We see a supportive underpin into next year for onshore aluminum and copper demand, given the current positive drivers are sticky,” the report forecasts.

China’s oil demand has also been rising on the back of a “rapid recovery” in oil-intensive services sectors such as transportation, although the analysts said a dip could be on the horizon.

“China’s demand for oil has been supported by record internal mobility, as indicated by robust congestion and domestic flight data,” Goldman observed.

“In our view, this robust level is sustainable, although we expect growth to decelerate significantly next year.”

Commodities as a ‘better bet?’

The surge in commodities comes in spite of a wider, faltering macroeconomic growth story in China.

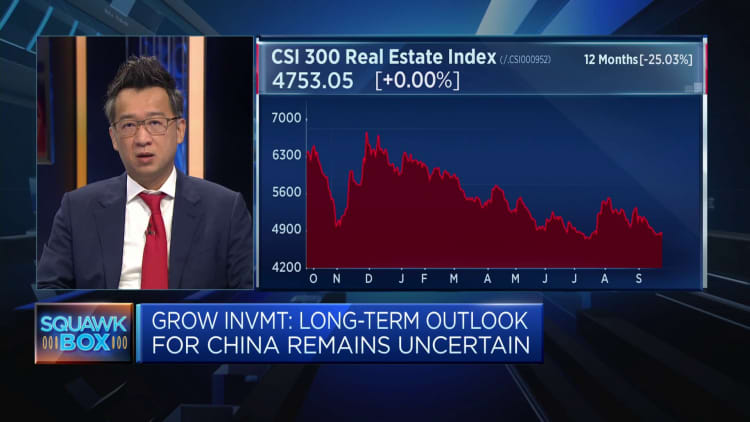

“You’re actually seeing commodities responding to the [People’s Bank of China’s] monetary expansion while the Chinese stock market is still trying to find the bottom,” said Grow Investment’s chief economist Hao Hong.

“So you’re seeing a huge split between the two asset classes,” Hong told CNBC on Tuesday.

The PBOC recently announced it will continue to boost macro policy adjustments, maintaining stable credit expansion and sufficient liquidity.

“Traders right now in the Chinese market are seeing commodities as a better bet on sort of a marginal improvement in the Chinese real economy going forward,” he observed.