A man wearing a Diego Maradona t-shirt walks by the Argentine Central Bank on November 30, 2023 in Buenos Aires, Argentina.

Tomas Cuesta | Getty Images News | Getty Images

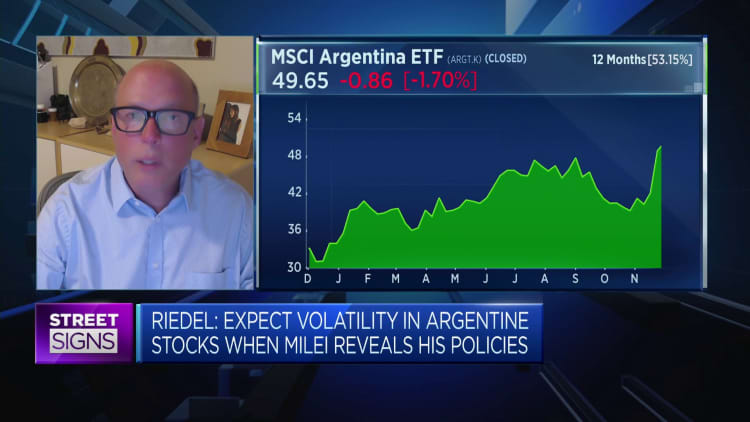

Argentina is in the grip of a profound economic crisis, and one veteran economist believes part of the solution is for President Javier Milei to deliver on his campaign promise to dollarize the economy and abolish the central bank.

Latin America’s third-largest economy is currently struggling to cope with the world’s fastest rising prices, which is hammering the purchasing power of Argentinians.

Data published Tuesday by the country’s statistical office showed that Argentina’s 12-month inflation rate through February rose to 276.2%, reaffirming Argentina’s position as having the world’s worst inflation.

Argentina’s government on Monday launched a massive peso debt swap in a bid to help stabilize the crisis-stricken economy and potentially pave the way for Milei to lift currency controls.

Steve Hanke, professor of applied economics at Johns Hopkins University, described the move as a “kick the can down the road type of operation.”

“They don’t need to buy any time, if they dollarized the economy and got rid of the central bank – something that Milei promised during his campaign, the thing would be fixed. And it is feasible to do that, and I think it is totally desirable,” Hanke told CNBC’s “Squawk Box Asia” on Thursday.

Hanke said that in 1999 he had drafted a law at the request of former President Carlos Menem that would have dollarized Argentina’s economy. The economist has previously said he’d been in close contact with Milei’s technical team and described himself as an “informal advisor” on issues such as dollarization.

President of Argentina Javier Milei speaks to lawmakers during the opening session of the Argentine Congress for the period 2024 on March 01, 2024 in Buenos Aires, Argentina.

Tomas Cuesta | Getty Images News | Getty Images

“We wouldn’t be talking about this, and they wouldn’t have defaulted over and over again if they would have dollarized way back in 1999. But at any rate, it looks like Milei has put the dollarization thing on the shelf and I think that will end Milei. This is a fatal mistake,” Hanke said.

“They are never going to get out of the soup by fooling around with this financial engineering, kicking the can down the road and trying to put in place what really is just a plain vanilla standard IMF [International Monetary Fund] program. These programs just don’t work [and] they have a history of not working,” he added.

A spokesperson for Argentina’s embassy in London was not immediately available to comment when contacted by CNBC.

‘Everything is nothing without stability’

Milei, who was recently accused of hypocrisy over a salary scandal, has struggled to gain the necessary support from lawmakers to enact his sweeping economic bill.

The libertarian economist, who was sworn in as president late last year and has often been compared to former U.S. President Donald Trump, has insisted there is no alternative to his proposed “shock therapy” if the government is to resolve the country’s economic woes.

Advocates of dollarizing Argentina’s economy say the switch could help the country tame skyrocketing inflation and bring an end to its boom-and-bust cycle. Critics, however, say the move would strip the country of its national sovereignty and dent Argentina’s ability to influence the economy through moves such as interest rate changes.

Ecuador and Panama are two notable examples of countries that have previously dollarized their economies, but no country of Argentina’s size has previously shifted to the U.S. dollar.

“To dollarize, you don’t need to have net foreign reserves that are positive,” Hanke said. “You have to have gross foreign reserves that are greater than the value of the peso notes and coins outstanding and I know all about this. This isn’t a theory I’m talking about, I’m not in a classroom. I did this in Ecuador,” he continued.

“In Ecuador, we dollarized it in 2000, 2001 and they had negative net reserves but they did have gross foreign exchange reserves greater than the sucre notes and coins that they had to swap out and we did it.”

Hanke said Argentina had “massive amounts” of U.S. dollar cash because the country is already “de facto dollarized.”

Asked about the U.S. interest of dollarizing Argentina’s economy, Hanke replied: “I think the U.S. interest is to have a stable Argentina. A big, powerful South American country that’s stable. Stability might not be everything, but everything is nothing without stability. That’s what the U.S. should be looking forward to and by the way you don’t have to get the permission of the U.S. government to do this.”