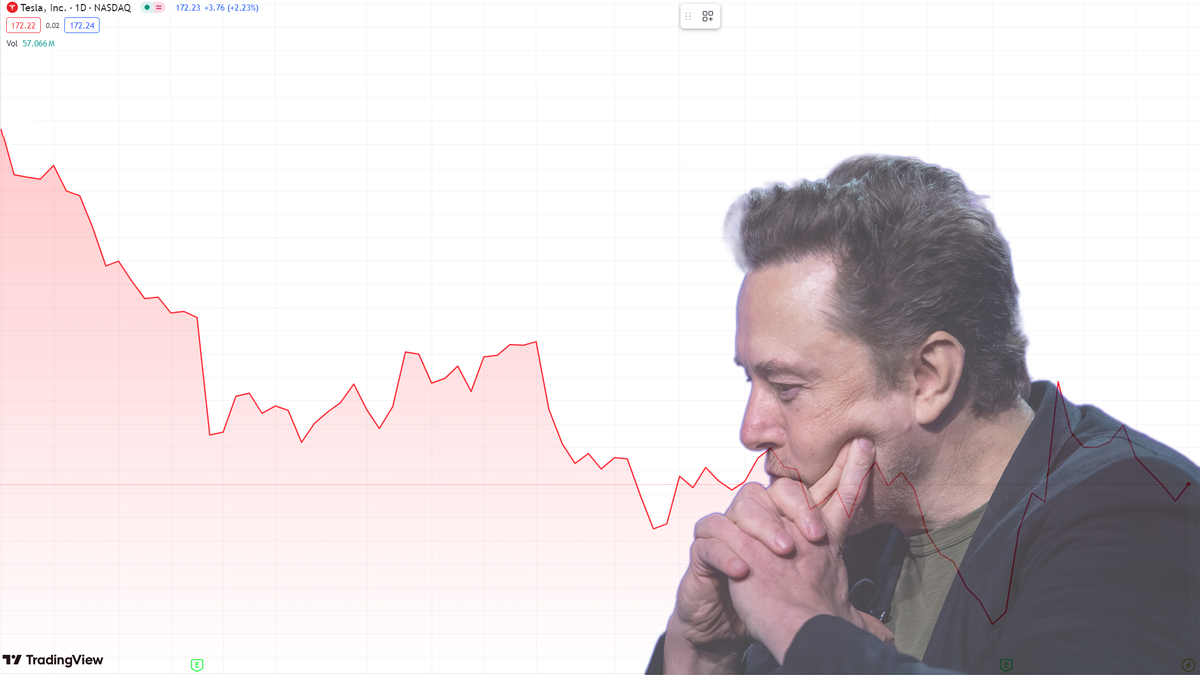

2024 has been a very bad year for Tesla so far. We’ve all read about the layoffs, the poor sales, and the deeply weird earnings call, but a closer look reveals even more behind the scenes. It’s about who is being laid off, why sales are down, and whether what Musk said on that call might be signaling his exit from Tesla entirely.

A viral Twitter thread from user Zero Sum Bond looked into just how bad the circumstances at Tesla are, declaring that the “walls are starting to close in” on the automaker. While the thread isn’t entirely accurate — tweets about Tesla keeping two separate copies of its books to fool regulators are only backed up by a suit that’s since been dismissed for lack of evidence — it’s a convenient compilation of some of Tesla’s biggest misses in recent months.

First on the agenda for Zero Sum Bond is the steady loss of many of Tesla’s top folks. A lot of folks have been wrapped up in the sweeping layoffs at the company, like Daniel Ho and Rebecca Tinucci, but others have left of their own accord — most notably HR head Allie Arebalo. Still others, like Cybertruck manufacturing head Renjie Zhu, left the company for reasons that are still unclear and we don’t know who made the call.

What’s more interesting than those who left, though, is what they did on the way out. People who were recently either restructured at or removed from high-level positions at Tesla are unloading their shares, like former CFO Zach Kirkhorn or now-former Musk right-hand-man Tom Zhu. Zhu, who is still employed at Tesla, holds fewer shares now than he did a year ago — despite thousands of shares awarded as compensation. Whatever’s going on behind the scenes, it’s possible it’s making even the inner circle lose faith.

Tesla is even going back on some of those layoffs, rehiring parts of the Supercharger team just weeks after gutting it. The move shows disorganization at the top, a shoot-from-the-hip mentality that seems incongruous with a company valued at $538.6 billion.

That valuation, of course, isn’t really matched by Tesla’s actual business. The company missed revenue and earnings per share targets last quarter, as it did for the two quarters prior. Softening EV demand is part of the issue, but Tesla has steadily dropped prices and market share at once — competition from more established automakers is simply getting tougher for the company to battle.

Tesla’s outdated inventory, save the new and issue-prone Cybertruck, certainly isn’t helping. Tesla sells some of the oldest new cars you can buy, which is a wonder in a world where even Toyota is changing the platform beneath the 4Runner. The faithful will tell you that Tesla is constantly iterating, always improving beneath the cars’ skin, but that’s a line that only works on the faithful — your average commuter sees a new car on the lot that looks nearly identical to one from ten years ago.

Tesla also has fewer avenues to hide its missteps. Traditional automakers can force cars down dealers’ throats in a move called channel stuffing, an unethical practice that shifts vehicles off the OEM’s books and tells local retailers to deal with it themselves. Automakers have been known to hide bad quarters through this method — Triumph once lost a CEO over the practice — but it’s not an option Tesla can use to sweeten its books. Not that it should, of course.

This, of course, is all before the myriad litigation Tesla faces over its semi-autonomous driver assist software. FSD and Autopilot are being investigated by the Justice Department for fraud, due to the implication of self-driving when the software truly can’t, while NHTSA is probing just how bad the systems really are, and whether mandatory recalls actually made as much of a difference as they promised to.

Yet, this software is what’s supposed to save Tesla: Musk himself said, “If someone doesn’t think Tesla’s gonna solve autonomy, I don’t think they should be an investor in the company.” The robotaxi project is the company’s new north star, and Musk believes it’ll be enough to save the company from its financial dire straits. Maybe he’ll open up another preorder round this August, hoping for some real money for nothing.

Sketchy software and vaporware promises may be enough to save a fledgling startup, but Tesla hasn’t been that kind of company for years. It’s the most valued automaker in the world, nearly doubling the market cap of Toyota. Tesla has had years to prepare itself for stronger competition, but it spent that time resting on its laurels and making fart jokes. Now, it seems, the market is finally realizing Tesla may be wearing nothing at all.