Investor optimism for Eli Lilly ‘s diabetes and obesity treatments in 2023 lifted the stock to its seventh annual gain in a row. In the new year, it should be the same old story. Shares of Eli Lilly have taken a breather over the past three months, as investors book profits in the top performer and redirect money to other parts of the market. It’s a trend that will likely continue in the coming weeks. But as 2024 progresses, Eli Lilly’s leadership in the fast-growing anti-obesity drug category – possibly worth $100 billion annually one day – may prove so apparent that the buyers return. Long-awaited approval of its Alzheimer’s drug would help, too. Eli Lilly is among the top 10 performing Club stock in 2023, climbing over 55%. That’s far better than the S & P 500 Health Care Sector index, which is down about 1%, and more than double the overall S & P 500 ‘s stellar 2023 performance. Diabetes and weight loss Eli Lilly’s weight-loss drug Zepbound and type-2 diabetes therapy Mounjaro are the most important drivers of the company’s stock in the year ahead, as they were in 2023. Quarterly revenue figures will be among the most important piece of information investors receive about the products, which share the same active ingredient known as tirzepatide. Jim Cramer has long said tirzepatide could become the best-selling drug of all time. “The supply is the issue. Eli Lilly has the balance sheet to build all the factories needed to make Mounjaro [for diabetes] and Zepbound [for weight loss] and that’s what will matter,” Jim said recently. “I think the probable approval of its anti-dementia drug will serve as a one-two punch for the stock to go higher,” he added. LLY .SPX YTD mountain Eli Lilly’s stock performance in 2023 compared with the S & P 500. Mounjaro was approved for type-2 diabetes last year and has handily exceeded Wall Street’s sales estimates for three quarters in a row. Zepbound received U.S. regulatory clearance in November and hit pharmacy shelves a few weeks ago. Early prescription data for Zepbound looks encouraging . Investors also will be looking for updates on insurance coverage, particularly whether more health plans provide reimbursement for Zepbound, adding to its commercial viability. As Jim mentioned, manufacturing capacity will be in focus, too, after Mounjaro faced supply shortages this year due to strong demand. Eli Lilly has been investing heavily to bring on more production facilities, as has Novo Nordisk , its chief rival in diabetes and obesity. The Danish firm makes Ozempic for diabetes and Wegovy for obesity. They share an active ingredient, semaglutide. Tirzepatide and semaglutide are both considered GLP-1s, which started as type-2 diabetes treatments nearly two decades ago before expanding into obesity and possibly other conditions like sleep apnea. GLP-1s mimic a gut hormone to improve blood sugar control and effectively suppress appetite, which helps contribute to weight loss. Despite being second to the GLP-1 obesity market, Jim expects Eli Lilly to ramp up production better than Novo Nordisk, eventually giving the Club holding the upper hand. Some investors are skeptical Eli Lilly’s strong performance can continue into 2024, said BMO Capital Markets analyst Evan Seigerman. “For all the bulls out there, there are definitely bears saying that this could be a slow launch, that there’s manufacturing issues, that there’s coverage issues. I think that all starts to work itself out and people get comfort,” he said. Seigerman added that the sky-high expectations around the weight-loss opportunity could put additional pressure on the stock. “Any whiff of issues with Zepbound could really weigh negatively,” he said. Additionally, if interest rates come down, Eli Lilly’s stock could be pressured by a rotation into riskier drug companies, like earlier-stage biotechnology firms, Seigerman said. In the near term, Eli Lilly’s presentation at the JPMorgan Healthcare Conference, set to be held from Jan. 8 to Jan. 11, is always a closely followed event. Meanwhile, in early February, Eli Lilly’s fourth-quarter earnings report — and the company’s 2024 guidance alongside it — represents a major catalyst for the stock, Seigerman said. Wall Street currently expects Zepbound sales to total $3.79 billion in 2024, while Mounjaro sales are projected to be $8.44 billion, according to consensus estimates compiled by FactSet. The combined estimate of $12.23 billion would represent nearly a third of companywide revenue. “The fact we’re still so early in this obesity launch is a reason to own it,” argued Seigerman, who has a $710-per share price target and buy-equivalent rating on Eli Lilly. “We’re very positive on it. I think estimates will come up throughout the year.” Alzheimer’s disease Another catalyst looming early in the year is unrelated to obesity and diabetes: The Food and Drug Administration’s decision on Eli Lilly’s experimental Alzheimer’s treatment , donanemab. That’s expected to arrive in the first quarter of 2024. Investors widely expect donanemab to be approved, thrusting the drug into a nascent market to treat the memory-robbing disease with just one commercially viable product, Leqembi. The FDA granted that therapy — made by Japanese pharmaceutical firm Eisai and its U.S. partner Biogen — full approval in July. In early November, Biogen said 800 people were currently being treated with Leqembi, though management expressed confidence in reaching its goal of 10,000 patients by the end of March. Actually receiving clearance is most important for donanemab. But from there, investors will pay close attention to Eli Lilly’s projected launch trajectory for the drug and initial sales estimates, Seigerman said. Wall Street forecasts donanemab’s 2024 revenue at $619 million, before rising to $1.12 billion in 2025 and $1.54 billion in 2026, according to FactSet. Seigerman said there are obstacles in the Alzheimer’s market — most notably having enough neurologists who can screen patients for the drugs — that are limiting the adoption of Leqembi. Once Eli Lilly is officially in the market, he said the company may do some of the heavy lifting on alleviating bottlenecks that would help both donanemab and Leqembi. Other catalysts Clinical trials examining tirzepatide’s effectiveness in treating other conditions, such as sleep apnea and heart failure, are expected to be completed in 2024. Potential updates on Lilly’s next-generation weight-loss treatments — retatrutide, which like tirzepatide is an injectable, and orforglipron, an oral drug — represent additional catalysts. A possible “sleeper asset” next year for Eli Lilly is lebrikizumab, a treatment for moderate-to-severe eczema that’s awaiting FDA approval, Seigerman said. In October, the U.S. regulator said it identified issues at a third-party manufacturer that needed to be fixed before lebrikizumab could be cleared. Analysts expect lebrikizumab — part of Eli Lilly’s increased emphasis on immunology drugs — to generate only $261 million in revenue next year but achieve blockbuster status in 2026, when sales are projected to be more than $1.3 billion. (Jim Cramer’s Charitable Trust is long LLY. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

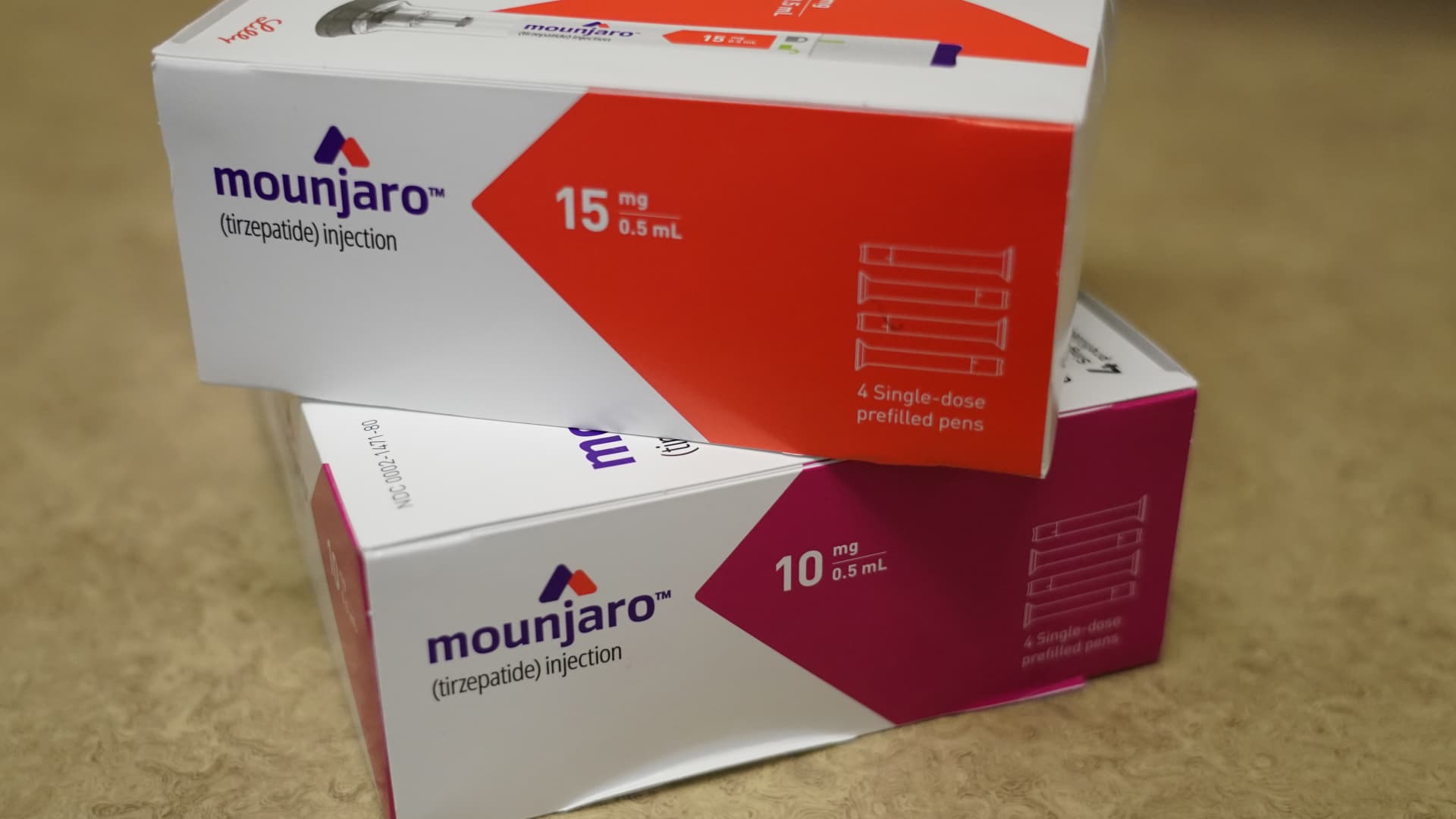

Eli Lilly & Co. Mounjaro brand tirzepatide medication arranged at a pharmacy in Provo, Utah, US, on Monday, Nov. 27, 2023.

George Frey | Bloomberg | Getty Images

Investor optimism for Eli Lilly‘s diabetes and obesity treatments in 2023 lifted the stock to its seventh annual gain in a row. In the new year, it should be the same old story.

Denial of responsibility! Secular Times is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – seculartimes.com. The content will be deleted within 24 hours.