After falling sharply last year, retirement account balances are bouncing back in 2023 — but there are still signs of trouble.

Helped in part by improved market conditions, retirement account balances increased in the first half of the year. However, the share of participants that tapped hardship withdrawals rose, as well, according to recent reports by Fidelity Investments, Bank of America and Vanguard.

“Hardship withdrawals are the worst way to get money out of a 401(k),” said Matt Watson, founder and CEO of financial wellness site Origin.

Federal law allows workers to borrow up to 50% of their account balance, or $50,000, whichever is less.

Under more extreme circumstances, savers can take a hardship distribution without incurring a 10% early withdrawal fee if there is evidence the money is being used to cover a qualified hardship, such as medical expenses, loss due to natural disasters or to buy a primary residence or prevent eviction or foreclosure.

Unlike a loan, that money can’t be repaid to the plan or rolled into an individual retirement account, on top of the potential tax consequences.

Retirement savings balances are up

The average individual retirement account balance increased nearly 3% year-over-year to $113,800 in the second quarter of 2023.

“We look at the dollar amounts, but we also look at behaviors,” said Mike Shamrell, Fidelity’s vice president of thought leadership.

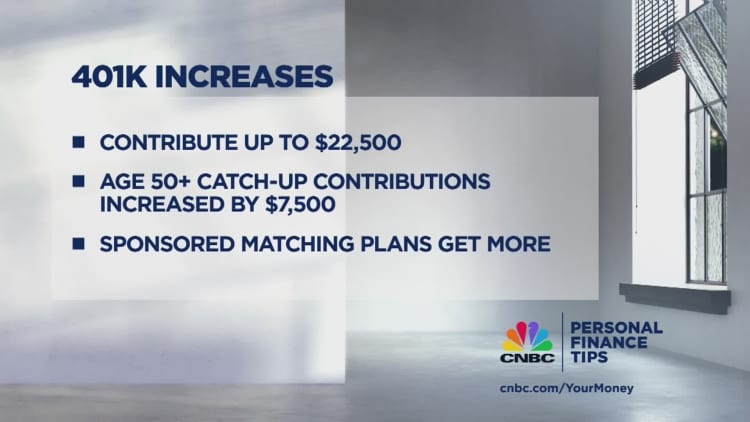

To that end, savings rates are solid, especially among younger workers, he said. The total savings rate for the second quarter, including employee and employer 401(k) contributions, was 13.9%, in line with last year.

Withdrawals an indicator of ‘financial strain’

But the percentage of participants with a loan outstanding also increased, Fidelity found, as did the share that took out hardship withdrawals, which reached 1.7% in the latest quarter.

Withdrawals are “another indicator of the financial strain that households are experiencing,” said Greg McBride, chief financial analyst at Bankrate.com. “It’s clearly indictive that millions of households continue to struggle even at a time when unemployment is at 3.5%.”

Reports from other 401(k) providers showed similar trends.

More participants took loans and hardship distributions compared to last year, according to Bank of America’s recent participant pulse report. Roughly 15,950 retirement savers withdrew money from a 401(k) plan to cover a financial hardship in the second quarter, up 36% year-over-year.

Vanguard’s report found that 401(k) hardship withdrawals hit a record high last year. Nearly 3% of workers participating in a 401(k) plan took a hardship distribution in 2022, according to Vanguard, which tracks 5 million savers.

“The data from our report tells two stories — one of balance growth, optimism from younger employees and maintaining contributions, contrasted with a trend of increased plan withdrawals,” Lorna Sabbia, head of retirement and personal wealth solutions at Bank of America, said in a statement.

Factor in a declining personal savings rate, record high credit card debt and more than half of adults living paycheck to paycheck, “it’s signaling that there are still some headwinds out there,” added Lisa Margeson, a managing director in Bank of America’s retirement research and insights group.

Hardship withdrawals ‘should be a last resort’

Still, hardship withdrawals “should be a last resort,” said Veronika Krepely Pool, professor of finance at Vanderbilt University. “It’s not a loan, you’re not actually putting that money back.”

Most financial experts advise against raiding a 401(k) since you’ll also be forfeiting the power of compound interest.

This is not necessarily like ‘I can’t pay for groceries.’

Mike Shamrell

Fidelity’s vice president of thought leadership

All other options should be exhausted first, Watson said, including tapping a home equity line of credit, liquidating an employee stock purchase plan or other brokerage assets, or even a 401(k) loan.

But in most cases, participants don’t “choose” a hardship withdrawal over other alternatives, noted Fidelity’s Shamrell.

“This is not necessarily like ‘I can’t pay for groceries.’ These are people who have had a significant and immediate financial situation,” Shamrell said.

And in some cases, especially for cash-strapped consumers living paycheck to paycheck, it may even make sense to cover the cost of an emergency all at once, rather than tap a loan that then gets deducted from your take home pay, he added.