A trio of the Club’s health-care stocks made news Thursday: Johnson & Johnson (JNJ) nabbed some positive research ahead of its earnings report next week, another Wall Street analyst expressed concerns about Humana (HUM), and the “rocky rollout” of an Alzheimer’s drug looks like a positive for Eli Lilly (LLY). Here’s a deeper look at the headlines and their implications for our investment theses in these holdings. JNJ YTD mountain Johnson & Johnson’s year-to-date stock performance. In the news: JPMorgan analysts expect Johnson & Johnson (JNJ) to report solid second-quarter results July 20, saying both its pharmaceutical and medical technologies are performing in line or slightly ahead of expectations. The firm also would not be surprised by another “modest guidance raise” for JNJ, analysts told clients in a note Thursday. In April, alongside its first-quarter results, J & J raised its full-year sales guidance by about $1 billion and its earnings-per-share outlook by 15 cents. In pharma, JPMorgan believes there will continue to be healthy results for Darzalex, Stelara and Tremfya — which Wall Street sees accounting for nearly 40% of the J & J’s drug sales in 2023, according to FactSet. J & J’s medical technologies division, meanwhile, is poised to “show continued momentum through the rest of the year,” due to a rise in surgical procedures in the U.S. and internationally, JPMorgan said. Still, analysts noted that J & J’s talc litigation — a major headwind for the stock — is progressing at a slower-than-expected pace. Clearing this overhang would help reduce the discount at which J & J shares to pharmaceutical peers, the firm said. The Club’s take: JPMorgan’s thinking on J & J aligns quite closely with our own. The company’s fundamental business is in very good shape, on both the pharma and MedTech sides. The dark cloud of talc lawsuits continues to keep a lid on J & J’s stock price. Plus, J & J’s large international exposure — at nearly 50% of sales in 2022 — means the year-over-year decline in the U.S. dollar is another positive in its favor. So while we also believe a solid second-quarter print could be in order, we’re in wait-and-see mode for the stock overall. In the very near term, the California trial involving a 24-year-old with terminal cancer will influence the direction of talc litigation . A decision in that case could be handed down any day. HUM YTD mountain Humana’s year-to-date stock performance. In the news: Wells Fargo cut its price target on Humana shares by 9%, to $561 each, as emergency room visits, outpatient surgeries and dental procedures among its Medicare Advantage customers rose in the second quarter. This elevated uncertainty around medical cost trends is depressing what investors are willing to pay for the health insurer’s shares, Wells Fargo said, meaning the stock is likely to trade at a lower multiple than before these concerns arose in mid-June. HUM is down more than 16% over the past month, by far the worst-performing Club holding during this period. For Humana’s stock to overcome its malaise, Wells Fargo said investors would need to see evidence that second-quarter medical cost increases were the result of pent-up demand and not the start of a multi-quarter trend. In any case, the firm said it maintained its buy rating on Humana shares because near-term earnings can be sustained, and its long-term position is still favorable. JPMorgan downgraded Humana last week to a hold , from buy, citing similar concerns as Wells Fargo. The Club’s take: It’s hard to disagree with Wells Fargo lowering its outlook for Humana’s stock price. The company has been in the doghouse ever since rival UnitedHealth Group (UNH) warned about a rise in outpatient surgeries in June. At this point, investors need more information from the industry on how medical cost trends are progressing and the extent to which second-quarter utilization levels were factored into 2024 Medicare Advantage plans, which companies needed to finalized in early June. Fortunately, we may get fresh insights when UNH reports earnings Friday and then a few weeks later when Humana’s second-quarter numbers are due out. This stock now requires patience, but hopefully at least some of the uncertainty can be alleviated soon. LLY YTD mountain Eli Lilly’s year-to-date stock performance. In the news: The first Alzheimer’s drug to receive full approval from U.S. regulators is facing a “rocky rollout,” Bloomberg News reported Thursday , based on conversations with doctors at leading memory clinics in the country. The drug — Leqembi, which Japanese pharmaceutical firm Eisai developed with U.S. partner Biogen (BIIB) — requires multiple scans and tests in order for patients to start the treatment course. Then, the drug is given intravenously every two weeks, and patients will need three MRIs prior to the fifth, seventh and 14 th infusions to monitor side effects, which can include brain swelling and bleeding. Bloomberg said some doctors are already writing prescriptions for Leqembi, while other hospitals including the Mayo Clinic in Rochester, Minnesota, are still working out the logistics and preparing for wide use in the fall. The Club’s take: Bloomberg’s reporting on Leqembi’s launch shows why we’ve routinely expressed measured optimism around Club holding Eli Lilly’s Alzheimer’s pursuits. Lilly’s drug a ppears to be effective at slowing progression of the memory-robbing disease , but it has not been the primary reason for our bullishness on the company because we’ve understood the complexities around launching a brand-new class of drugs for such a complex condition. Bloomberg’s story also points to why Eli Lilly’s drug — known by the scientific name donanemab — being second to market is not necessarily a competitive disadvantage. Analysts have said there is room for multiple drugs, and that having three companies (Eisai, Biogen and Eli Lilly) in the market should help in building out the infrastructure in the U.S. medical system that’s necessary for a meaningful amount of patients to receive the treatment. It’s worth noting that fellow Club holding GE Healthcare ‘s (GEHC), which makes products that can confirm an Alzheimer’s diagnosis and monitor side effects, could eventually see a benefit from broad usage of these drugs. (Jim Cramer’s Charitable Trust is long JNJ, HUM and LLY . See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

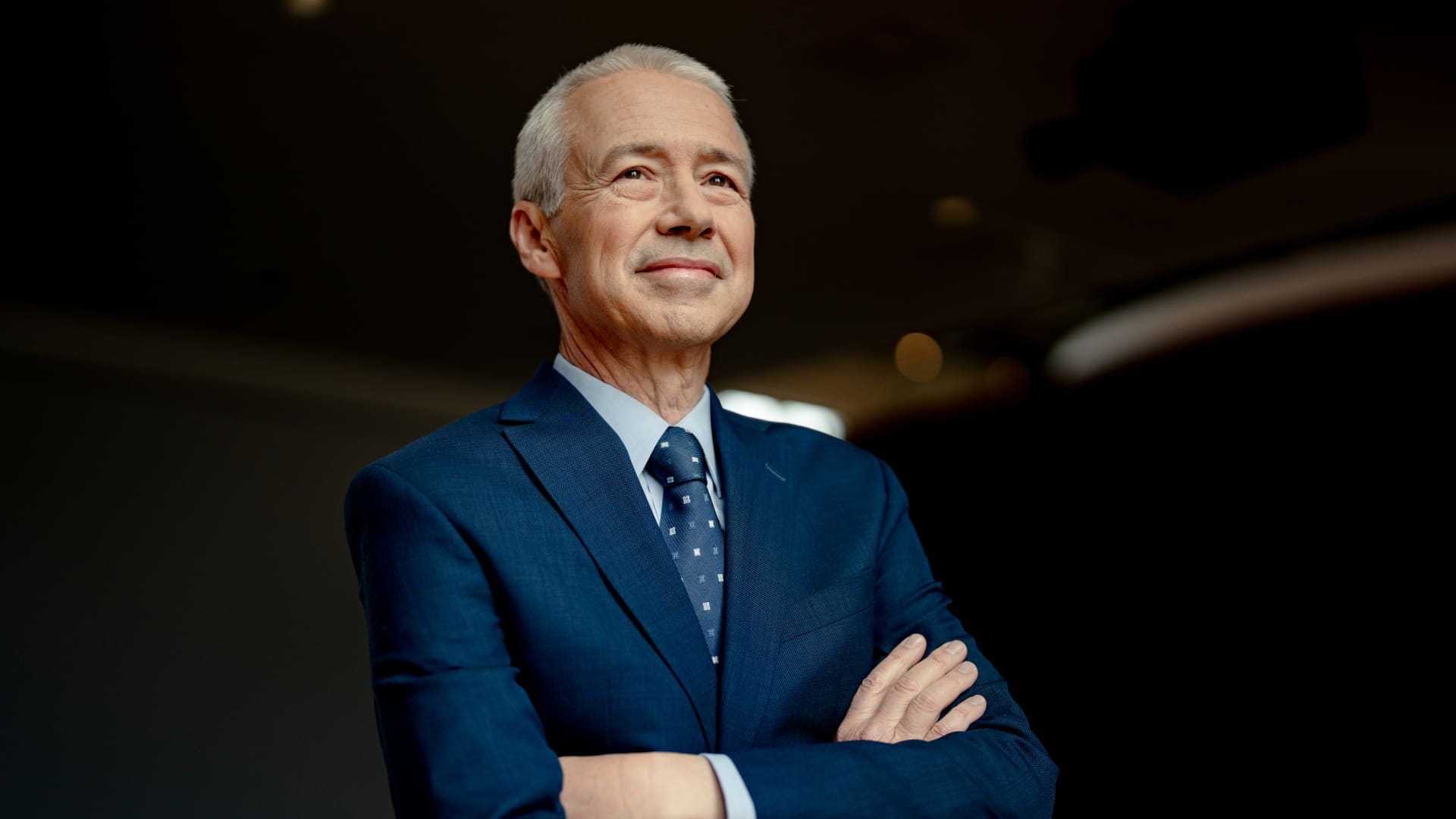

Joaquin Duato, chief executive officer of Johnson & Johnson, at the company’s headquarters in New Brunswick, New Jersey, U.S., on Thursday, April 21, 2022.

Amir Hamia | Bloomberg | Getty Images

A trio of the Club’s health-care stocks made news Thursday: Johnson & Johnson (JNJ) nabbed some positive research ahead of its earnings report next week, another Wall Street analyst expressed concerns about Humana (HUM), and the “rocky rollout” of an Alzheimer’s drug looks like a positive for Eli Lilly (LLY).

Here’s a deeper look at the headlines and their implications for our investment theses in these holdings.

Denial of responsibility! Secular Times is an automatic aggregator of the all world’s media. In each content, the hyperlink to the primary source is specified. All trademarks belong to their rightful owners, all materials to their authors. If you are the owner of the content and do not want us to publish your materials, please contact us by email – seculartimes.com. The content will be deleted within 24 hours.